Bitcoin ETFs

Beginning this week, CoinFactiva.com observed miner revenue and Bitcoin ETF activity closely.

Blackrock’s IBIT remained prominent, with 415 BTC inflows ($27m) on Tuesday, while Grayscale’s GBTC experienced 1k BTC outflows, totaling 1250 BTC ($79m). At this rate, IBIT is poised to surpass GBTC in BTC holdings by month-end.

Overall, net outflows continued, amounting to -916 BTC ($58m). Following a volatile start to the year and a bullish February/March, some ETF investors may be adjusting to Bitcoin’s recent sideways movement.

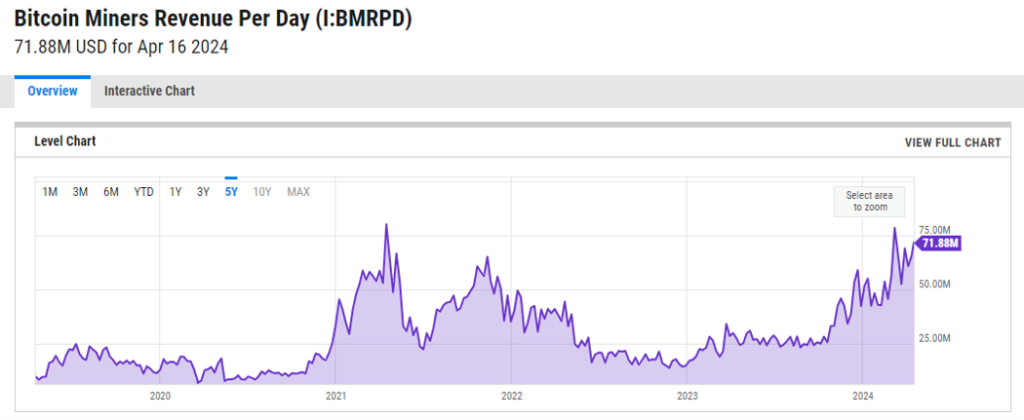

Miner revenue

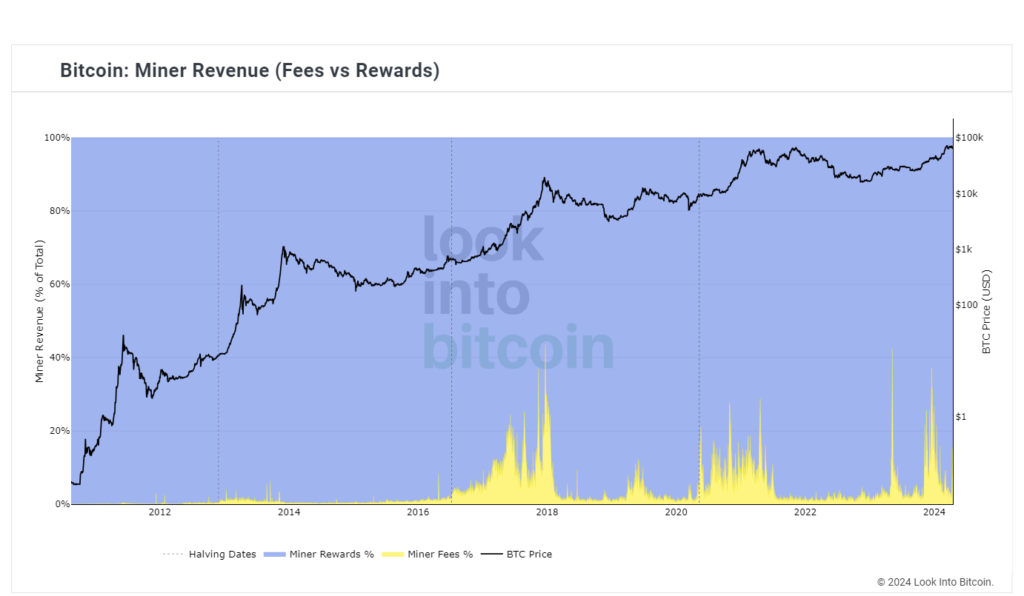

In the mining sector, the chart bellow illustrates daily miner revenue, predominantly sourced from the Block Reward. As of April 16, 2024 it was more than $71M! With Friday’s halving set to reduce this reward by half, from 6.25 BTC to 3.15 BTC per block, miners face increased pressure, especially those with higher operational costs. While historical trends suggest BTC price increases post-halving, the industry remains fiercely competitive, with many miners facing challenges.

Fiat World

In traditional finance news, Jerome Powell’s remarks at a policy forum hinted at a delay in rate cuts due to a lack of progress toward the 2% inflation goal. Conversely, Christine Lagard suggested potential rate cuts from the ECB, noting Europe’s success in controlling inflation. Monitoring developments, particularly in the EUR/USD chart, could signal the opportune moment to plan that summer getaway to Italy.