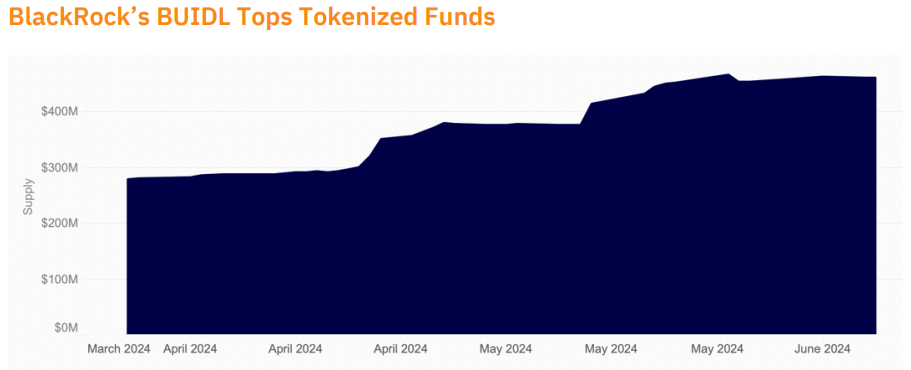

BlackRock’s BUIDL Tops Tokenized Funds

BlackRock’s BUIDL, a tokenized liquidity fund, continues to grow and now holds over $460 million. Since launching in March, BUIDL has outpaced several crypto-native firms and Wall Street rival Franklin Templeton. Additionally, Fidelity International joined JP Morgan’s tokenized network, becoming the latest institutional player. Overall, tokenized funds have attracted over $1 billion in assets under management, reflecting growing investor demand for on-chain yield-bearing funds.

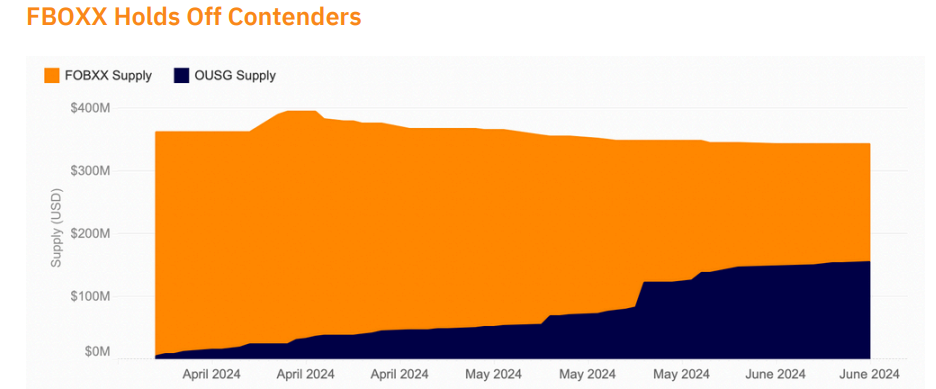

Franklin Templeton’s FBOXX and Emerging Challengers

While Franklin Templeton’s FBOXX surpassed $270 million in assets under management in April 2023, BUIDL overtook it in Q2. Despite this, FBOXX remains the second-largest tokenized fund. Challengers like Ondo Finance’s OUSG have made significant strides but are still less than half the size of FBOXX. Ondo Finance itself has strong ties to traditional finance, with most of its executive team from Wall Street firms, and its two largest clients being BlackRock and PIMCO.

FBOXX Holds Off Contenders

Though BUIDL surpassed FBOXX in Q2, FBOXX remains a significant player with $270 million in assets. Ondo Finance’s OUSG, while growing, is still less than half the size of FBOXX. Ondo Finance’s traditional finance connections include executives from Wall Street and major clients like BlackRock and PIMCO.