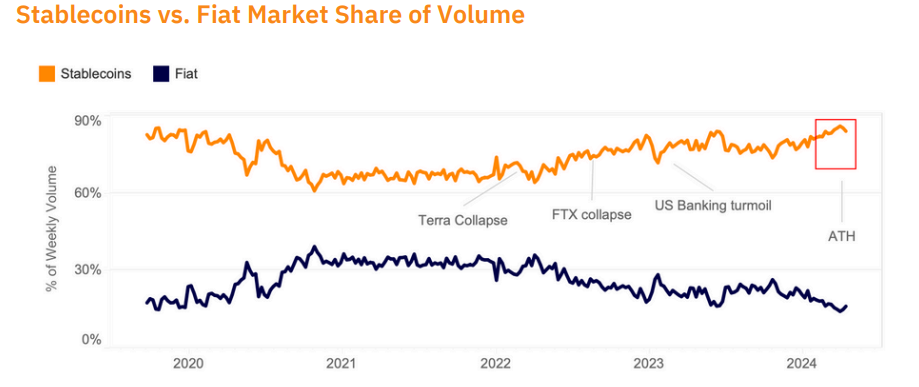

Stablecoins vs. Fiat Market Share

Despite high-profile collapses and de-pegging events, stablecoins continue to gain market share over fiat. This trend indicates strong demand for stablecoins. At the end of the quarter, USD and EUR-pegged stablecoins reached an all-time high market share of 84%. In contrast, fiat currencies accounted for just 16% of all crypto transactions. Although Tether’s USDT leads the stablecoin market, its dominance has been weakening over the past two years.

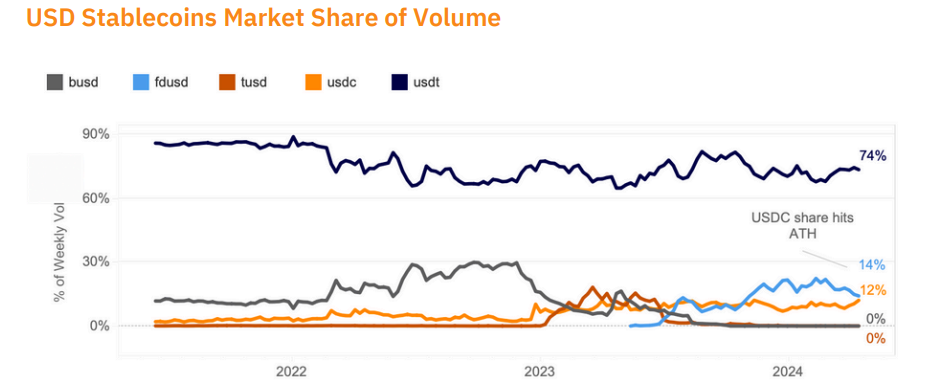

USD Stablecoins Market Share on Centralized Exchanges

In 2024, USDT’s market share on centralized exchanges (CEXs) fell from 82% to 74%. This decline was partly due to competition from stablecoins like FDUSD, which benefited from Binance’s zero-fee promotions. Additionally, rising demand for regulated alternatives like USDC contributed to this shift. By the end of June, USDC’s market share hit an all-time high of 12%, driven by volumes on Binance, Bybit, and OKX. Yield-bearing stablecoins also gained traction, with issuers like Paxos and Tether launching their own alternatives in Q2 to capture this demand.