Derivative Markets Trends

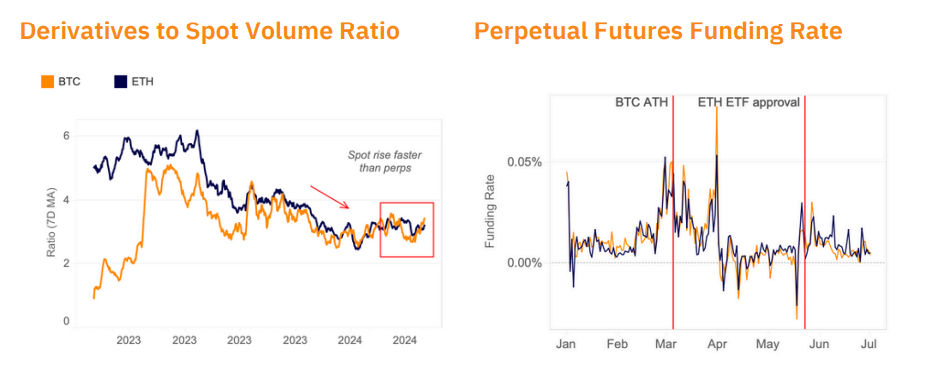

In Q2, a shift in market sentiment was evident in derivative markets. Perpetual funding rates remained neutral to slightly positive. These rates were significantly below March’s multi-year highs.

ETH Open Interest and Bullish Demand

ETH open interest hit an all-time high of $11 billion following spot ETH ETF approvals in late May. However, bullish demand remained subdued during this period.

BTC Derivatives-to-Spot Volume Ratio

The BTC derivatives-to-spot volume ratio measures the relative growth of perpetual to spot volumes. This ratio was mostly flat throughout Q2. It declined significantly from 6-7 in September 2023 to around 3 in June 2024. This decline signals the growing significance of spot markets.

Optimism for ETH’s Long-Term Prospects

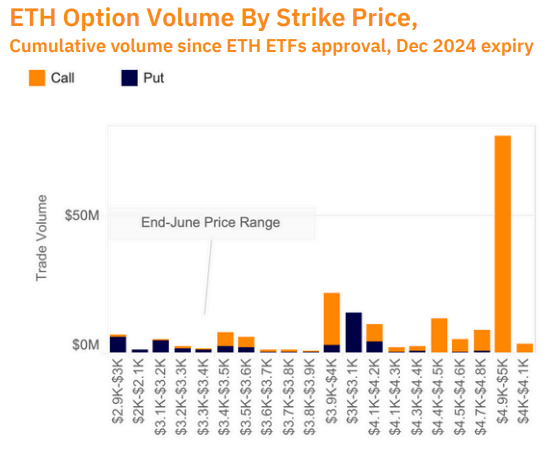

Despite short-term bearishness, traders remain optimistic about ETH’s long-term prospects. ETH option volumes for December expiries show a trend of traders buying calls at higher prices than current levels. This trend may be due to an improving outlook around ETH.

Regulatory Concerns Around ETH Staking Products

Regulatory concerns are growing around ETH staking products. At the end of June, the SEC sued MetaMask wallet maker Consensys over its MetaMask swaps and staking products.