Impact on EUR-Backed Stablecoins

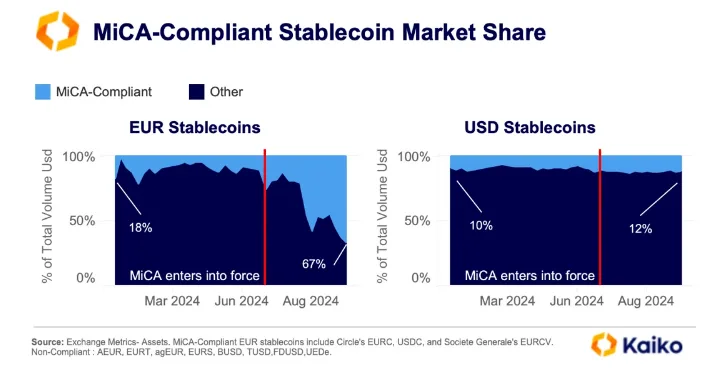

The European Markets in Crypto-Assets Regulation (MiCA) took effect in June, causing significant changes in the stablecoin landscape. Major exchanges delisted non-compliant stablecoins, with Coinbase announcing the removal of USDT for European users by year’s end. Within three months of MiCA’s introduction, EUR-backed stablecoins saw notable shifts. MiCA-compliant coins, like Circle’s EURC and Société Générale’s EURCV, now hold 67% of the EUR-stablecoin market.

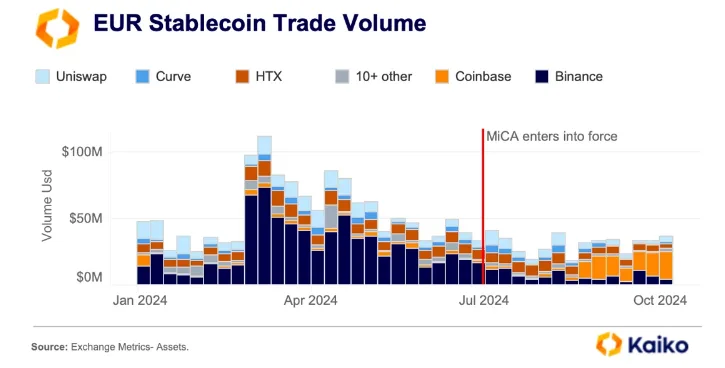

Coinbase has been a key driver in this change, surpassing Binance as the top platform for EUR-backed stablecoins. Binance, meanwhile, promotes non-compliant euro stablecoins outside Europe through a zero-fee model. Despite these market changes, overall EUR-stablecoin trading volume has remained stable at around $30 million weekly, much lower than the $100 million level recorded in March.

Shifts in USD-Backed Stablecoins

USD-backed stablecoins have also felt MiCA’s effects. USDC, the largest MiCA-compliant USD stablecoin, saw its market share rise slightly from 10% to 12%. However, further shifts may come as Coinbase plans to delist USDT for European users, which could benefit regulated stablecoins like USDC.

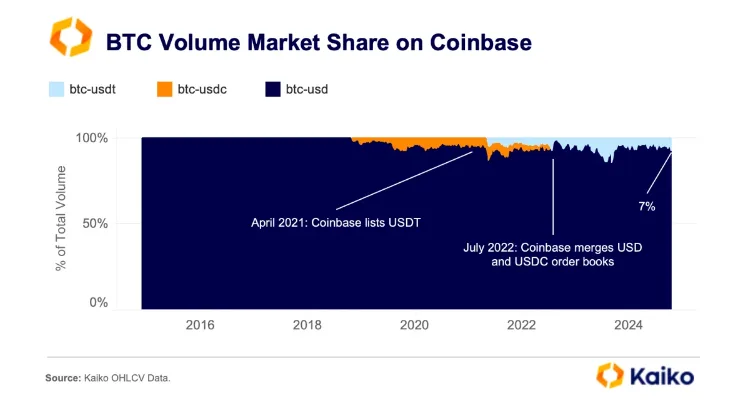

USDT, a non-compliant stablecoin, has seen rapid global adoption, maintaining a strong market presence. After being listed on Coinbase in 2021, USDT’s trading volume against Bitcoin rose from 1% to over 5% by the end of the year. Its dominance remained steady, even after Coinbase merged its USD and USDC order books to improve liquidity.

DeFi and DEX Implications

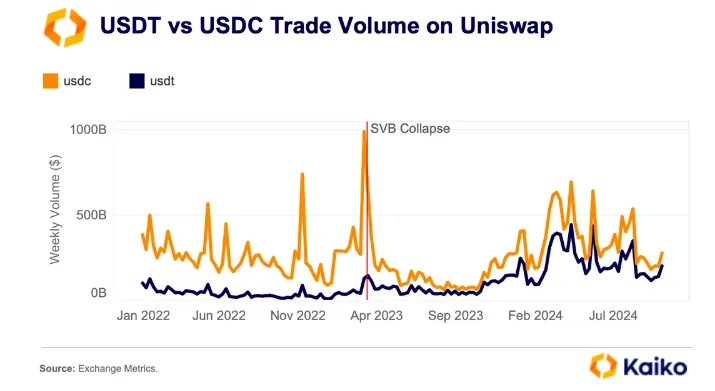

MiCA could also influence the competition between stablecoins on decentralized exchanges (DEXs). Since DEXs aren’t regulated by MiCA, they continue trading USDT, which remains the most liquid stablecoin. This unrestricted trading could further increase USDT’s popularity, especially in decentralized finance (DeFi) markets. The trend has already started, with USDT gaining market share on Uniswap, a leading Ethereum DEX, after the US banking crisis.

On the other hand, USDC has lost its dominance on Uniswap. After its sharp depeg following the collapse of Circle’s banking partner, Silicon Valley Bank (SVB), USDC’s market share fell from 90% in 2022 to 55% recently. This drop signals a shift in DeFi stablecoin preferences, with USDT emerging as a strong competitor.