Ethereum ETFs Launch

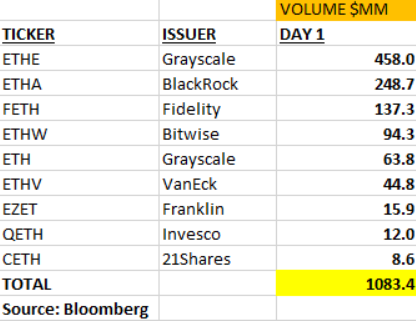

On July 23, Ethereum spot ETFs launched in the US. This provided easy access to altcoins for mainstream investors. The first-day trading volume for these new instruments reached $1.1 billion.

Investment Comparison

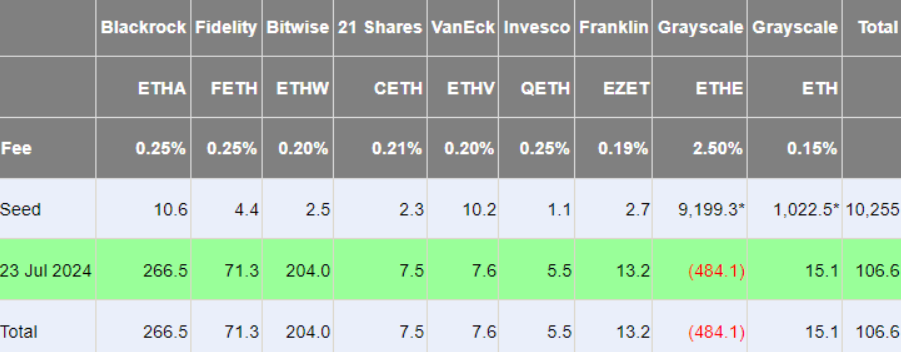

Compared to Bitcoin ETFs, this was 24.4% of the trading volume. This matched optimistic forecasts. However, Ethereum’s net inflows were six times lower than Bitcoin’s, at $107 million versus $655 million.

Impact of Grayscale

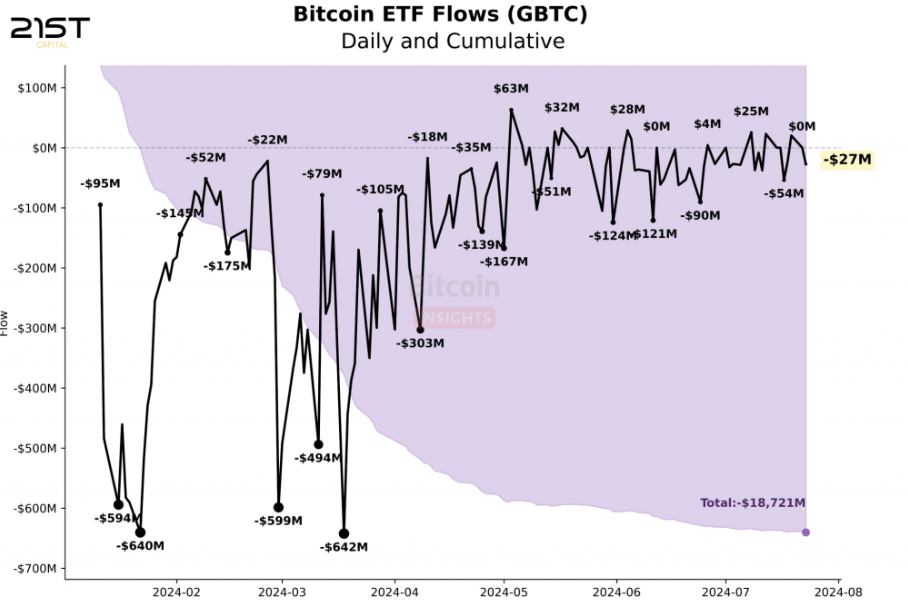

Grayscale’s transformation of its ETHE fund from trust to spot exacerbated the situation. Earlier warnings about its negative impact were confirmed. Grayscale’s reserve, worth $10 billion, aligns with positive annual inflow predictions. However, the base scenario predicts only a quarter of Bitcoin ETF results, or $4 billion in six months.

Potential Investor Exodus

If ETHE’s outflow rate matches GBTC’s, investor exodus will exceed new ETF inflows significantly. On the first day, ETHE lost $484.1 million, five times worse than GBTC.

Factors Affecting Investment Interest

Several factors could further dampen investment interest. First, the lack of staking in ETFs deprived Ethereum of a key passive income advantage. Second, Ethereum lags behind competitors like Tron and Solana in practical applications.

Third, Ethereum’s low funding rate limits hedge fund interest. During Bitcoin ETF launch, the rate was 15%, rising to 70% by February. This led to a $7 billion short position on CME by the third quarter’s end, with a corresponding spot market purchase. For Ethereum, the rate hovers around 7-9%, insufficient to attract this group.

Future Predictions

The first week’s inflows will reveal which trends dominate. Preliminary analysis suggests weak investment interest and significant outflows from ETHE. This will likely widen the gap between Bitcoin and Ethereum over the next three months.