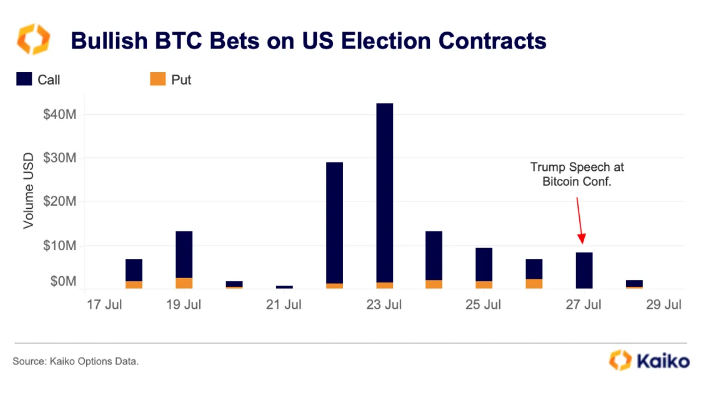

Surge in BTC Options

Options traders flocked to bullish bets on BTC for Deribit’s new US election contracts. These options, expiring on November 8, launched on July 18.

High Volume of Trades

Traders bought $41 million worth of BTC calls on July 23. Weekend trade volumes spiked when Donald Trump spoke at the Bitcoin 2024 conference. On the conference’s final day, traders bought $8 million worth of calls.

Bullish BTC Bets

The highest volume strike for November 8 BTC contracts was $75,000. This reflects traders’ belief that Trump will win the election. He pledged to embrace cryptocurrency and not sell any seized BTC if elected.

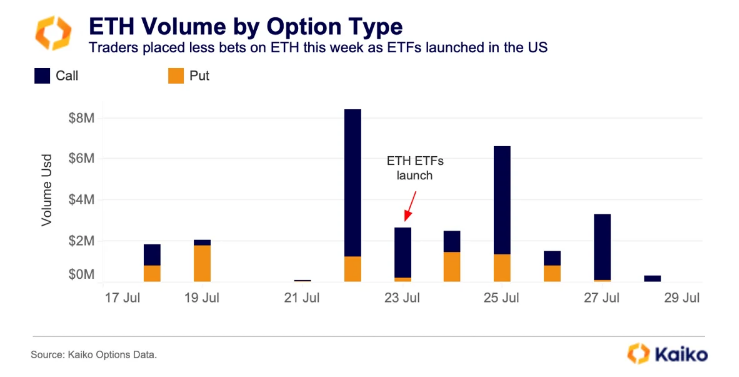

ETH Options Activity

ETH options on Deribit saw less action compared to BTC. However, ETH contracts experienced a spike in volume before last Tuesday’s spot ETF launch. Traders bought $7 million worth of ETH calls and $1 million worth of puts.

Smaller but Bullish Volumes

Most ETH options volume coalesced around strike prices between $4,500 and $6,000. Despite smaller volumes compared to BTC, the sentiment remained very bullish.

Investor Strategy: Election-Driven Options Trading

Diversify with BTC and ETH

Traders are placing bullish bets on BTC for Deribit’s US election contracts, set to expire on November 8. The highest volume strike for BTC contracts is $75,000. This indicates traders’ belief that Donald Trump’s potential win could boost BTC prices. Additionally, there is notable activity in ETH options, with volumes around strike prices between $4,500 and $6,000. Despite lower volumes compared to BTC, the sentiment remains bullish.

Monitor Political Events

Political events, such as Trump’s speech at the Bitcoin 2024 conference, have caused significant spikes in trading volumes. Investors should stay informed about political developments and their potential impact on the cryptocurrency market.

Capitalize on Market Sentiment

The large volumes in BTC and ETH options reflect a strong bullish sentiment among traders. Investors should consider taking advantage of this by entering positions that align with the prevailing market sentiment.

Focus on Key Strike Prices

For BTC, the $75,000 strike price has seen the highest volume. For ETH, key strike prices are between $4,500 and $6,000. Investors should consider these levels when planning their options strategies.

Balance Risk and Reward

Options trading around significant political events can offer high returns but also carries risk. Investors should balance their portfolios to manage potential volatility and capitalize on bullish trends without overexposing themselves to risk.

*not a financial advise