The DeFi bull market, initiated in the summer of 2020 with the liquidity mining of COMP, has transformed many DeFi protocols into rapidly growing revenue monsters. One might assume this places them in a comfortable financial position, and a cursory glance at DAO treasuries seems to confirm this.

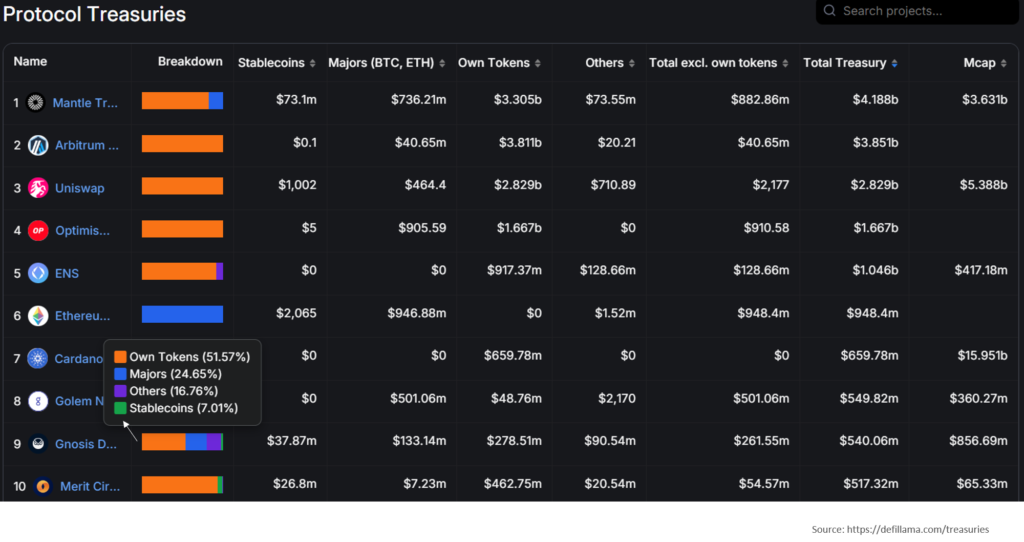

For instance, CoinFactiva.com suggests that leading DeFi protocols sit on hundreds of millions or, in the case of Mantle, Arbitrum, Uniswap, Optimism, ENS, even billions of dollars.

However, almost all of this presumed treasury value stems from the projects’ own tokens, such as UNI, COMP, and LDO, as shown in the following graphs: check out orange checkmark in the breakdown column.

While CoinFactiva.com analysts agree that a project’s own tokens in its treasury can be financial resources, treating them as assets on their balance sheet brings more harm than good and is often used as justification for poor treasury management. To clarify this point, let us take a small detour into traditional accounting.

Own tokens are not assets

While DeFi tokens are not considered stocks in a legal sense, we can still learn from how traditional companies account for their stocks. In simple terms, float (all shares available for public trading) and restricted shares (employee shares currently vesting) together constitute a company’s outstanding shares.

These outstanding shares are a subset of authorized shares—the self-limiting soft cap on total issuance. The key point is that shares that have been authorized but not issued are not accounted for on the company’s balance sheet. And how could they be? Accounting for unissued shares would allow the company to arbitrarily increase its assets simply by authorizing more shares without selling them.

We hope you see the connection with DAO’s own tokens in their treasuries: they are the crypto-equivalent of authorized but unissued shares. They are not assets of the protocol, merely indicating how many tokens the DAO could “legally” issue and sell on the market.

Whether DAO authorizes a small or very large number of tokens into its treasury, it does not matter: it says nothing about its actual purchasing power.

To illustrate this point, imagine Uniswap tried to sell only 2% of its treasury. Executing this trade through 1inch, which routes orders across many internal and external markets, would result in almost an 80% price impact on UNI.

Real DeFi treasuries

Ignoring authorized but unissued shares allows us to get another, much more accurate picture of DeFi treasuries.

First, it’s not enough to issue new shares, you also have to sell them in the market. This creates price impact, which quickly becomes a constraint for large sales. But beyond that, the price the market pays for your own token is not guaranteed, but highly volatile.

Secondly, this price depends on overall market conditions. The crypto market has gone through several speculative cycles where tokens can reach euphoric valuations, but can also crash by 90%+ and remain there for a long time.

Thirdly, times when DeFi projects urgently need liquidity can correlate with project-specific risks: for instance, when a project experiences a major insolvency event due to a bug or hack and wants to compensate users for damages, the token price is also likely to be suppressed—especially if holders expect dilution event.

Case Study: MakerDAO’s Black Thursday Exposes Treasury Risks

The risk of insufficient reserves in the treasury isn’t merely theoretical, as experienced firsthand by MakerDAO during the market crash on March 12, 2020, commonly referred to as “Black Thursday.” The lack of liquid assets endangered MakerDAO’s credit system, leading to a potential collapse. While the crisis was eventually averted, it resulted in a significant decline in token values. Let’s delve into how it unfolded:

From its launch in 2018 until March 2020, MakerDAO used its net profit to buy back and burn MKR tokens (returning capital to token holders), burning a total of 14,600 MKR valued at over 7 million DAI. The average price of the MKR token during this period was around $500.

Then came Black Thursday, and due to sharp price declines and Ethereum network congestion, Maker was unable to liquidate losing positions in a timely manner, resulting in a protocol loss of 6 million DAI. Subtracting the 500,000 DAI in MakerDAO’s treasury at the time, it had to cover the remaining 5.5 million losses by auctioning MKR tokens on the market. Maker ultimately sold only 20,600 MKR at an average price of approximately $275.

By December 2020, Maker’s accumulated profit managed to reduce the token supply to the initial volume of 1 million MKR through repurchases, costing over 3 million DAI (again with an average MKR price of around $500). To offset the financial aftermath of the 6 million dollar credit loss from Black Thursday, Maker wiped out 10 million dollars of profit accumulated over 3 years. An additional 4 million dollars in losses could have been avoided if Maker had more reserves in the treasury in stable assets like DAI, as they could have used these funds to cover unsustainable loans without needing to sell MKR at depressed prices. In other words, Maker could have seen up to 4 million dollars of additional accrued value by holding a larger treasury.

While it’s challenging to estimate treasury needs in advance, the 500,000 DAI Maker had on Black Thursday was almost certainly inadequate. It represented just 0.35% of the protocol’s 140 million dollar loan capital buffer, whereas most traditional financial institutions hold at least 3-4% of risk capital. And this is before considering operational expenses and salaries, which can trigger additional forced sales during a market downturn if not covered by non-native treasury assets.

Understanding Buybacks and Dividends

The fact that many DeFi projects naively regard their token as a treasury asset and may be forced to sell it at the worst possible time is a result of a lack of methodology on how to do it better. While there are many ways to manage a protocol, the following set of recommendations can be useful practices.

Guidelines for DAO Treasury Management

Guideline 1: The DAO’s objective is to maximize long-term token holder value.

Guideline 2: When put into action, Guideline 1 implies that every dollar owned or earned by the protocol must be allocated to the most profitable use, considering the present value discount. Typically, options include holding funds in the treasury, reinvesting in growth or new products, or distributing to token holders through token buybacks or dividends. If funds yield higher returns for token holders outside the protocol (after taxes), it is correct to distribute the funds instead of retaining or reinvesting them. In practice, we see many DeFi protocols distributing funds that could be used for growth or saved in the treasury for future expenses. According to our methodology, this is a significant mistake. In the case of Maker, we witnessed how it sold cash for tokens but then had to repurchase the same cash with tokens at a much higher cost of capital.

Overall, we recommend abandoning the idea that dividend payouts or token buybacks somehow “reward” token holders, while internal reinvestment does not. The most profitable decision for token holders is one that maximizes returns from every dollar, whether inside or outside the protocol.

Guideline 3: Adhering to the above rules, the DAO becomes an acyclic trader of its own token. If the DAO sees its token is overvalued, and internal reinvestment yields good returns, it should sell tokens for cash and reinvest that cash into the protocol. This is almost certainly the case in all bull markets. When the DAO sees its token price below fair value, and it has excess cash with low internal returns, it can buy back tokens. This is almost certainly the case in all bear markets.

Towards Better Treasury Management Finally, we want to share our views on how DAOs should manage their treasuries. We have arrived at the following rules:

Guideline 4: DAOs should immediately write off their own tokens from their treasury—they are the crypto-equivalent of authorized but unissued shares.

Guideline 5: DAO treasuries must survive the next bear market. This may not happen next week or next month, maybe not even next year. But in a market as speculation-dependent as crypto, it will happen. Build a treasury that will last you 2-4 years, even if the entire market crashes by 90% and remains there for some time. 2-4 years is perfect specifically because you want enough to survive even the longest crypto winter by known standards but not so much as to become rich and lazy, or too distracted from working on your protocol as a hedge fund.

Considering the known operating expenses of large DAOs with big developer teams and liquidity mining programs, very few, if any, meet this condition today. This means that most or all of them must use the bull market to sell tokens and create real treasuries with stable assets that will not only allow them to survive the upcoming bear market but, hopefully, propel them ahead of their competitors.

Disclaimer

Be forewarned that the content within our website is presented in utmost sincerity and intended for informational purposes only. Any course of action undertaken based on this information is solely at the reader’s discretion, assuming full responsibility for their decisions. This content also does not seek to persuade or advise anyone to invest, as it does not offer financial or trading guidance. We urge you to exercise caution and conduct thorough research, seeking guidance from a skilled financial advisor, before engaging in cryptocurrency or securities investments.