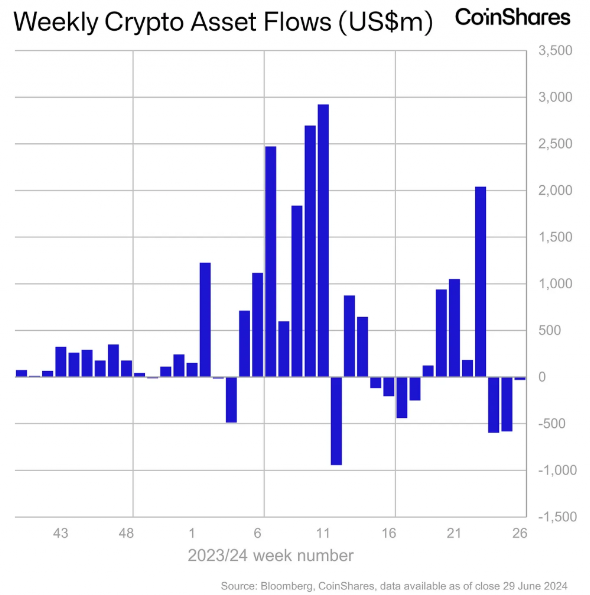

Continued Outflow

Cryptocurrency exchange-traded funds (ETFs) are experiencing outflows for the third consecutive week. A total of $1.2 billion has been withdrawn globally.

American Bitcoin-ETFs

The majority of losses came from American spot Bitcoin-ETFs. On June 7, they peaked at $15.9 billion. Over the last four working days, inflows resumed but remain significantly below the daily average of $126 million.

Hong Kong Bitcoin-ETFs

The situation is even worse for Hong Kong Bitcoin-ETFs. They started on May 2 with $248 million and have since lost $30 million, a 12.1% decline.

Causes of Decline

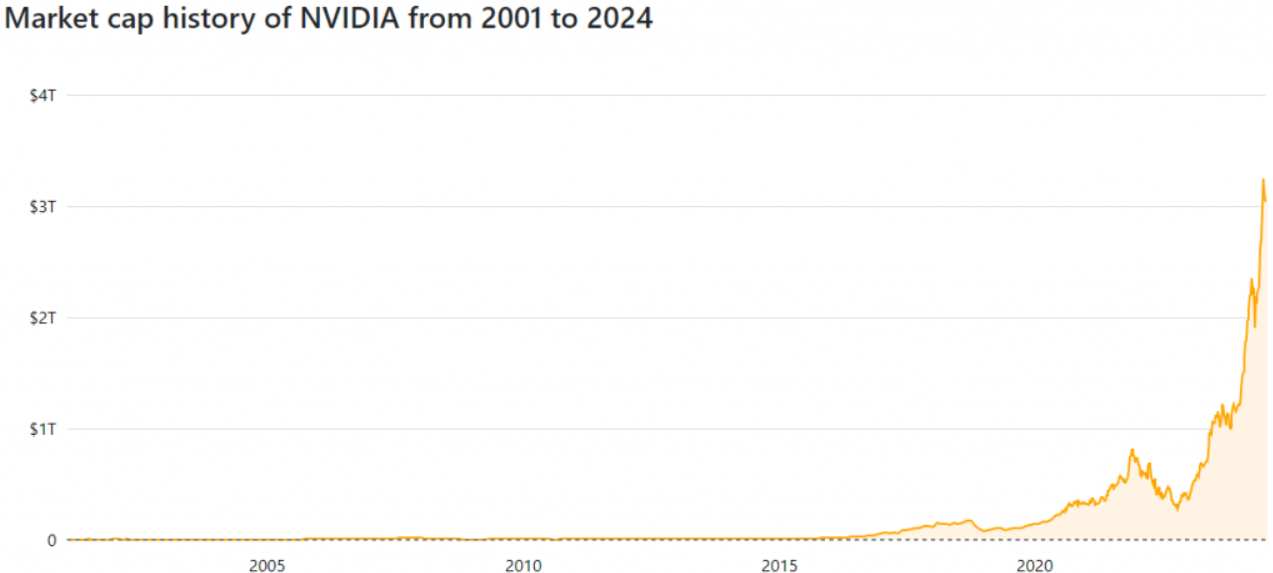

The prolonged consolidation of Bitcoin is dampening investor sentiment. Retail investors, who typically don’t plan long-term, contributed about half of the inflow into spot ETFs. Many shifted their focus to the booming AI sector, particularly NVIDIA stocks, withdrawing funds from cryptocurrency funds.

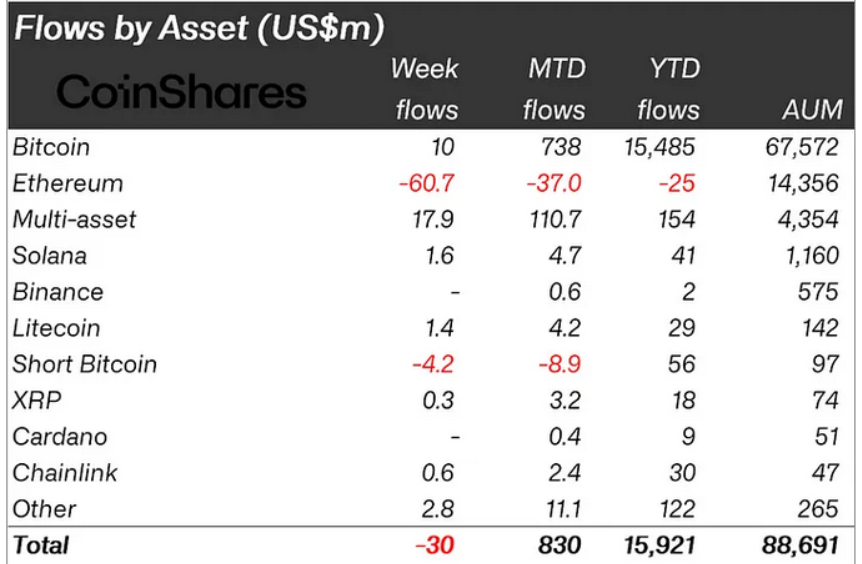

Ethereum Outflow

Ethereum deserves special attention due to significant outflows. Despite anticipated approval of spot ETFs in the US this month, investors withdrew $119 million in the last two weeks, the highest since August 2022. In the first half of the year, Ethereum was the only cryptocurrency with negative performance.

SEC Delays

Last week, the SEC rejected S-1 filings for Ethereum spot ETFs, requesting additional amendments by July 8. Approval is now expected mid-month or later.

Future Outlook

Without new catalysts, leading cryptocurrencies are likely to continue drifting within the current range. However, long-term prospects still suggest potential growth.

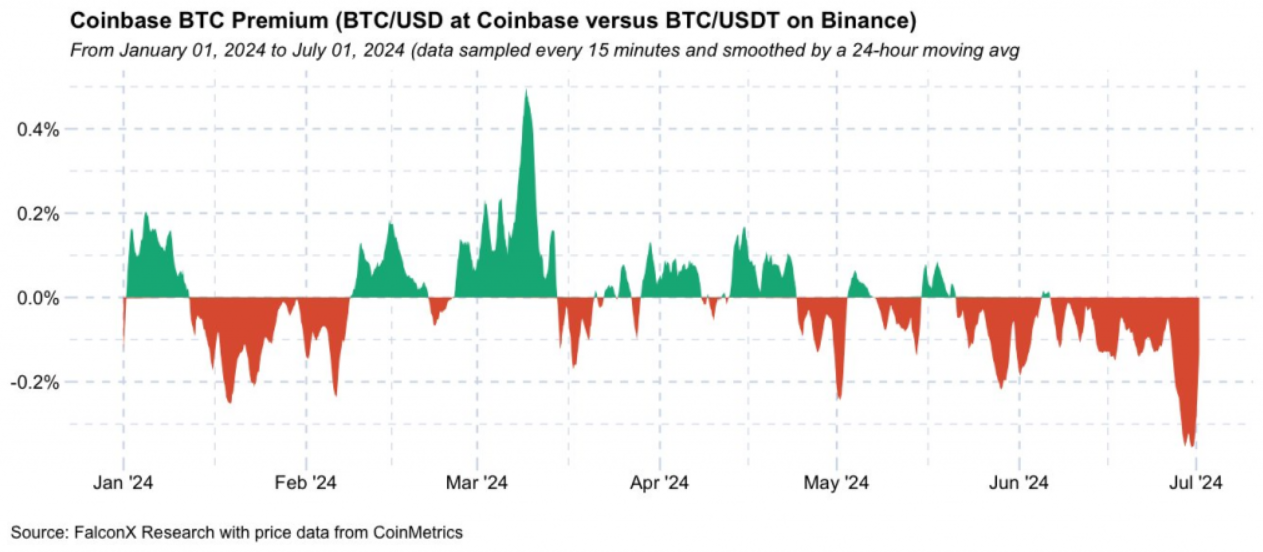

Signs of a Rally

David Lowant, head of research at FalconX, noted a future rally indicator. The Coinbase premium against Binance (Bitcoin price difference) has dipped back into negative territory. The last such dip was in October 2023, followed by a 1.6-fold increase in Bitcoin over three months.