SEC Chair Signals Smooth ETF Registration Process

On June 25, SEC Chair Gary Gensler noted the smooth progress of Ethereum ETF registrations. The approval date depends on applicants submitting revised S-1 forms promptly. Eric Balchunas and other Bloomberg analysts expect new products to be approved by July 2, based on the SEC’s sudden show of leniency. Reuters, citing anonymous sources, confirmed that a consensus has been reached between managers and the SEC, with only final touches remaining.

Ethereum Futures Interest Near Record Levels

Open interest in Ethereum futures stands at $14.6 billion. This is close to the record $16.5 billion reached on May 28. The neutral financing rate indicates mixed expectations among participants.

Positive Impact of a New Exchange-Traded Product

The anticipated exchange-traded product is undoubtedly a positive factor. Bitwise CIO Matt Hougan predicts a $15 billion net investment inflow into the ETF within the first 18 months. His analysis draws from the experience in Canada and the EU, where Bitcoin and Ethereum inflows have a 4:1 ratio. If spot Bitcoin ETFs saw $26.9 billion in the first quarter, Ethereum is expected to attract $6.7 billion. This could push Ethereum funds to $4400-$5000 within three months.

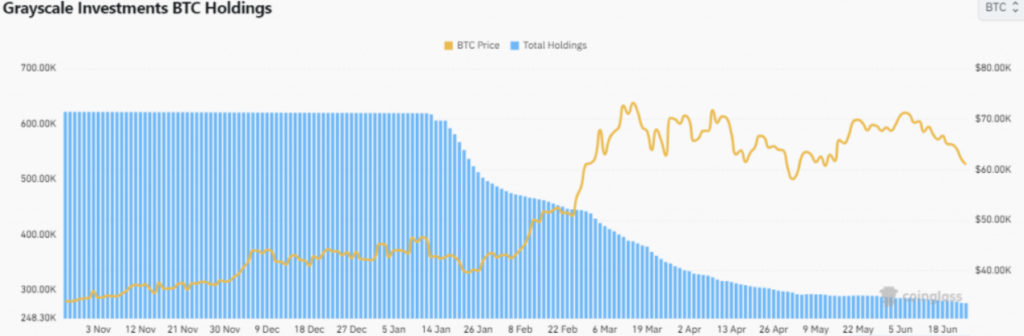

Grayscale’s Influence and Market Challenges

However, Hougan overlooks the negative impact of outflows from Grayscale. After converting GBTC, the fund lost 45.9% of its coins, or 284,000 BTC, in the first quarter. Grayscale’s ETHE fund holds $10 billion in Ethereum. If investors exit at a similar rate, sales pressure could reach $4.6 billion, with a net inflow of $2.1 billion, six times worse than Bitcoin ETFs.

Staking Withdrawal and Its Implications

Ethereum faces additional challenges due to the forced staking withdrawal. Annual yields from locked coins are currently 3.2%, exceeding 10% with restaking. Investors may see Ethereum losing a key advantage over Bitcoin: passive income.

Potential Overestimation of Demand for New ETFs

These factors suggest that the potential demand for new ETFs might be greatly exaggerated. The unlocking of ETHE fund assets could trigger another correction phase.