Bitcoin inflow to cryptocurrency exchanges at a 10-year low.

While some analysts predict Bitcoin’s decline to $40,000, and others talk about the end of the bull cycle due to the achieved update of the price record, network metrics indicate growing demand pressure.

The current cycle deviates from the usual order of things with the premature update of the historical level, which was driven by a significant influx of capital due to the approval of spot ETFs in the US. Over the past three weeks, the influx has turned into outflow, confirming the hypothesis of the end of the impulse and a potential reversal.

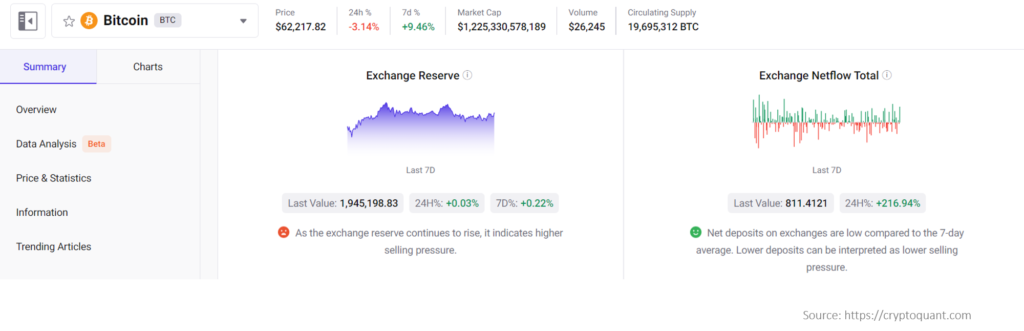

ETFs have become a significant argument in 2024, but far from the only one. The leading role is still played by hodler sentiments and long-term market participant evaluations. One of the key metrics is the influx of Bitcoin to cryptocurrency exchanges. The more people willing to exchange it for stable coins or fiat money, the greater the influx.

At the end of April, the indicator plummeted below the level of 10,000 BTC per day, reaching a 10-year low.

High interest in savings is also indicated by the continued rapid influx of coins to accumulation addresses. These include addresses where two or more incoming transactions are recorded and where there is no outflow of funds.

The overall picture is marred by the decrease in the share of coins remaining inactive for more than a year, from 70.8% at the end of November to the current 65.8%. However, it is necessary to take into account that almost half of this trend was provided by the transformation of the Grayscale trust fund into a spot ETF. One part of investors rushed to lock in profits, while the other transferred investments to similar funds with lower management fees.

Since the conversion, this fund has “slimmed down” by more than half to 292,000 BTC.

As for time intervals and expectations of new highs, the growth after the halving lasts from 350 to 500 days.

During the first two months, consolidation with minor price fluctuations was always observed.

As indicated by analysts at CoinFactiva.com, it’s premature to draw conclusions about the new cycle. Therefore, crypto investors should remain patient, especially considering that it’s just less than a month since April’s Bitcoin halving.