The long-awaited altcoin season is postponed: Over the past eighteen months, Bitcoin has surged by 72% to $63,000. Initially, the focus was on the launch of spot ETFs in the US, followed by the halving.

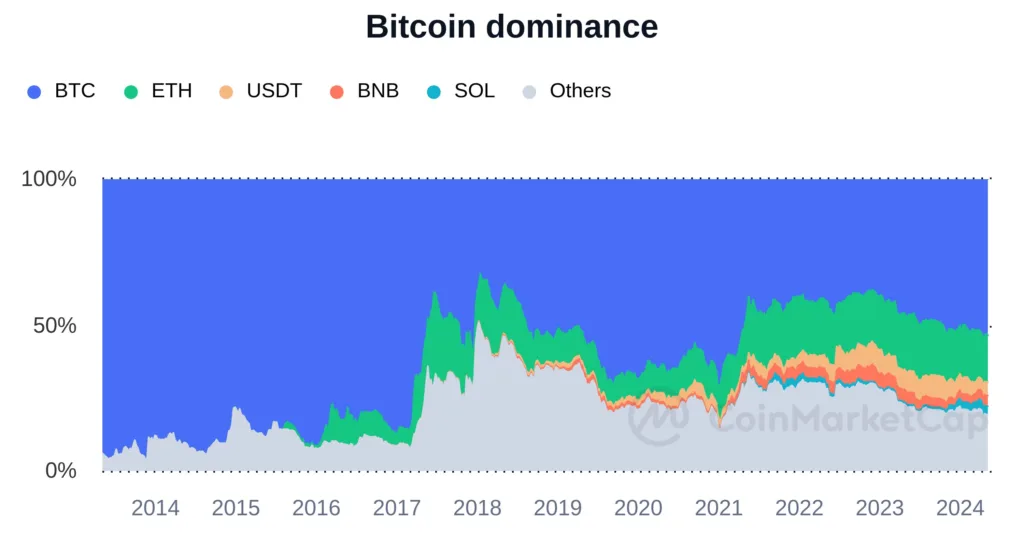

This drew investors’ attention to Bitcoin, causing its market share to rise from 38% to 54%.

In previous cycles, speculative frenzy spread to altcoins after Bitcoin, as traders sought promising projects capable of generating hype for high profits. In 2023, this trend was distorted by the introduction of the Ordinals protocol, allowing new coins to be minted on almost any network.

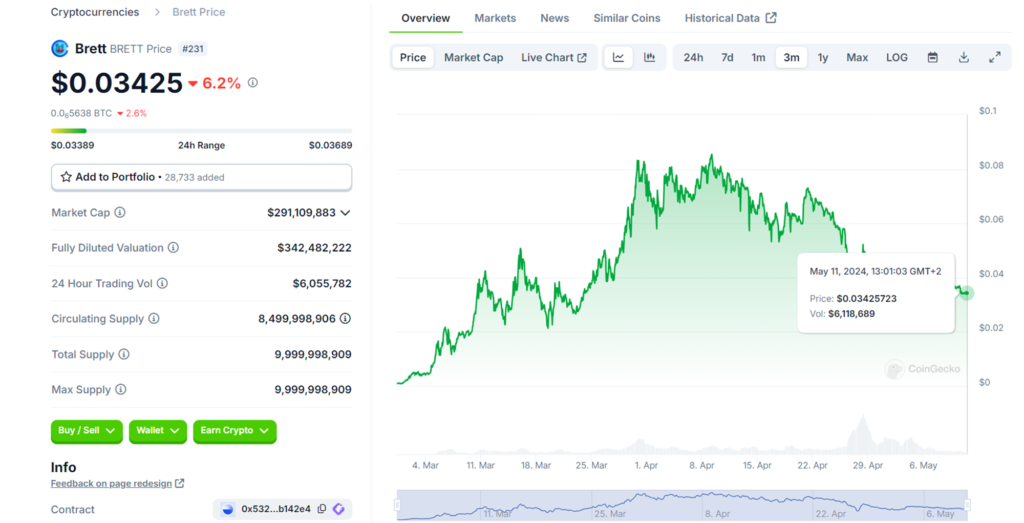

The first wave hit Bitcoin, leading to a significant increase in fees. The frenzy then shifted to other networks, resulting in transaction processing difficulties. For instance, the top ten quasi-tokens showed a growth of 1313% in the first quarter of 2024. The leader during this period was Brett on the Base network (L2 on Ethereum), with a growth of 7728%.

As interest in such products is fleeting, all this speculative activity does not lead to a reshuffling of forces in the cryptocurrency rankings. The same Brett plummeted by 58% from its peak, leaving “late” buyers with losses. The situation could be rectified by promising projects through the implementation of innovative products.

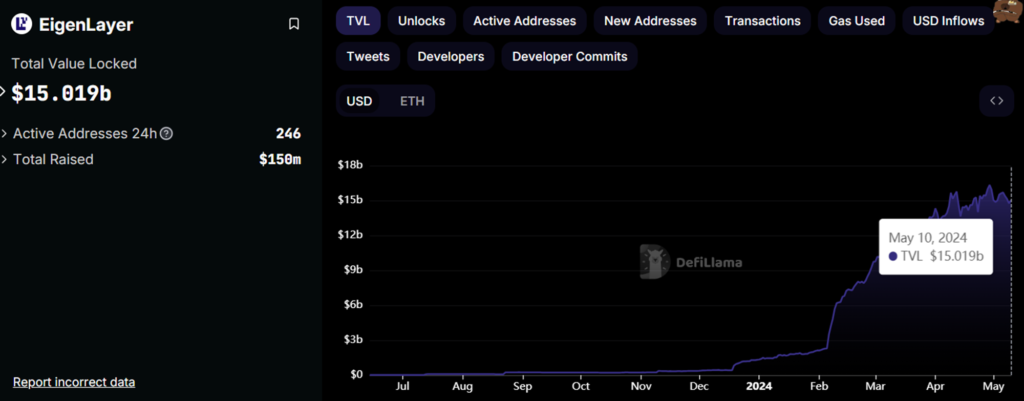

One such platform was the EigenLayer restaking platform, whose Total Value Locked (TVL) grew from $1.3 billion to $14.8 billion this year.

This is one of the best results in the DeFi sector. However, according to CoinFactiva.com analysts, the team made several mistakes in the planned airdrop, sparking community outrage. Firstly, points were awarded for trading activity and locked volume of funds, but the reward program turned out to be extremely opaque.

At the last moment, developers announced a ban on the distribution of EIGEN tokens to citizens of China, the US, and Canada.

Secondly, after the airdrop, tokens will be locked for trading, which was also unexpected. Thirdly, those who used third-party platforms to participate in the program will receive tokens only in the second season (the conditions and timing of which are not specified).

The opaque incentive program and last-minute rule changes seriously damage the investment attractiveness reputation of young projects.

Traders find it more interesting to trade runes and ordinals than to show activity in startups, where the financial outcome depends on the goodwill of developers, and reward programs are rewritten at the last moment.

Disclaimer

Be forewarned that the content within our website is presented in utmost sincerity and intended for informational purposes only. Any course of action undertaken based on this information is solely at the reader’s discretion, assuming full responsibility for their decisions. This content also does not seek to persuade or advise anyone to invest, as it does not offer financial or trading guidance. We urge you to exercise caution and conduct thorough research, seeking guidance from a skilled financial advisor, before engaging in cryptocurrency or securities investments.