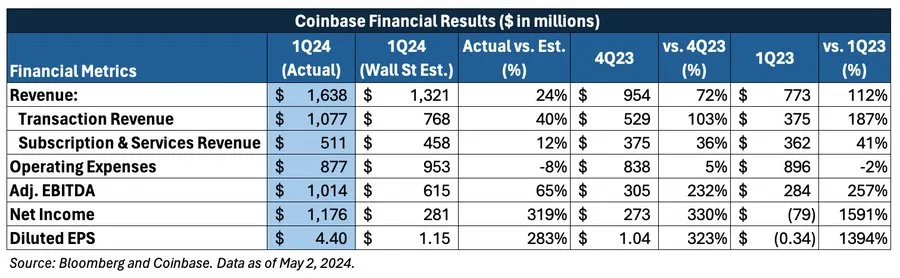

Coinbase outperformed expectations in its first-quarter earnings report released on Thursday, resulting in the stock trading approximately 2% lower in extended trading. Here’s a breakdown of how the company fared compared to analyst projections from LSEG:

- Earnings: $4.40 per share, which may not be directly comparable to the average analyst estimate of $1.09.

- Revenue: $1.64 billion, surpassing the expected $1.34 billion.

As the leading marketplace in the U.S. for digital token transactions, Coinbase reported a net income of $1.18 billion, or $4.40 per share, contrasting sharply with a loss of $78.9 million, or 34 cents per share, in the same period last year. This profit includes a $650 million mark-to-market gain on crypto assets held for investment due to updated accounting standards adopted by the company.

Consumer transaction revenue surged to $935 million for the quarter, marking over a 100% increase from the previous year. Total transaction revenue nearly tripled to $1.08 billion. Historically, transaction revenue has been the main driver, supplemented by subscription and services revenue, which amounted to $511 million for the quarter.

Coinbase shares climbed nearly 9% on Thursday ahead of the earnings report, contributing to a year-to-date increase of around 32% following a remarkable fivefold surge in 2023. The stock typically benefits from significant gains in bitcoin, as rallies in the cryptocurrency boost trading volumes and demand for related services.

During the first quarter, bitcoin reached a new all-time high above $73,000 in March, while ethereum underwent its first major upgrade in over a year.

The approval of several new U.S. spot bitcoin exchange-traded funds by the Securities and Exchange Commission attracted a wave of institutional investors, many of whom partnered with Coinbase as their custody provider. These funds collectively amassed over $50 billion by the end of the quarter.

However, cumulative net inflows peaked on April 8 and have since declined, coinciding with a decrease in bitcoin prices. Despite these achievements, Coinbase faces legal challenges from the SEC, with a judge ruling in March that the regulator’s allegations of unregistered securities sales could proceed to trial by jury.

Furthermore, the company faces emerging competition from Crypto.com, which has regained market share in recent months.

During the first quarter, a number of individuals within Coinbase, including four members of the C-suite, sold a combined $383 million worth of the company’s shares, as observed by analysts at Raymond James. This figure represents more than double the amount sold in the fourth quarter of 2023 and marks the highest level of insider selling since the company’s listing on the Nasdaq Stock Market in 2021.

Raymond James highlighted that the most significant seller among them was co-founder and board member Fred Ehrsam, who realized $129 million from the sale of his shares.