Bybit’s Rise in the Crypto World

Bybit Fintech’s crypto exchange has climbed to the second spot globally by trading volume. This success comes from targeting former FTX clients and users in Europe and Russia.

Filling the FTX Void

Based in Dubai, Bybit’s growth accelerated by offering a service that uses digital tokens as collateral for margin trading. Co-founder and CEO Ben Zhou noted that Bybit seized the opportunity after FTX’s collapse.

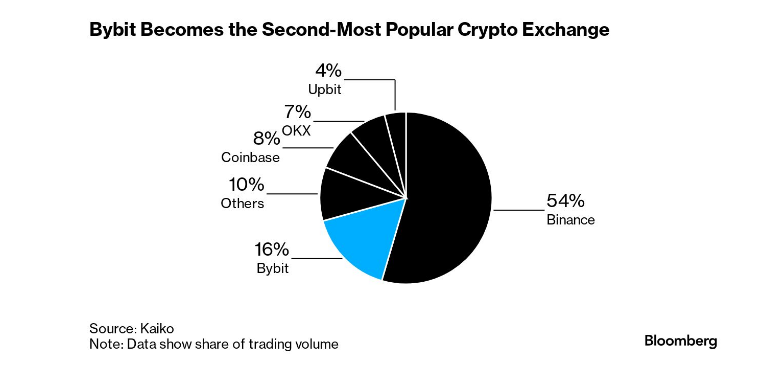

FTX’s bankruptcy, associated with Sam Bankman-Fried’s fraudulent activities, created a significant market gap. Bybit’s share of trading volume doubled to 16% since October, surpassing Coinbase Global in March. Only Binance Holdings surpasses Bybit in spot and derivatives transactions.

Crypto Market Recovery

Exchanges have benefited from Bitcoin’s price doubling over the past year and the debut of dedicated US exchange-traded funds. This surge marks a recovery from a bear market and scandals, particularly FTX’s downfall in 2022.

Following FTX’s collapse, Bybit introduced a trading account for cross-margin trading with over 160 tokens. Users can utilize unrealized profits to open new positions. Zhou highlighted this unique feature as a significant advantage.

Bybit’s Market Expansion

Europe is Bybit’s largest market, contributing 30%-35% of volumes. Additionally, the Commonwealth of Independent States (CIS), including Russia, accounts for about a fifth of the volume. Zhou emphasized the potential for growth in these regions, despite heavy scrutiny on crypto use in Russia due to sanctions.

Navigating Sanctions

Bybit adheres to strict sanction rules when dealing with Russian clients. The company is establishing an office and seeking a digital-asset license in Georgia, following a permit in Kazakhstan.

Impact of Binance’s Legal Issues

Bybit’s progress coincides with a plea deal between Binance and US authorities, involving a $4.3 billion penalty and jail-time for Binance’s co-founder Changpeng Zhao. Bybit, primarily serving overseas customers, is adjusting as regulations on digital-asset businesses tighten.

Exploring New Markets

Europe’s dominance is waning due to new rules under the Markets in Crypto-Assets Regulation framework. Bybit is now focusing on emerging markets like Brazil, Turkey, and Africa.

Reaching Out to Chinese Expats

Bybit recently opened its platform to Chinese citizens living abroad, despite Beijing’s crypto trading ban. Zhou mentioned growing demand from Chinese expats and assessed the risks of serving them as “relatively low.”

Strengthening Prime Broker Relationships

Bybit is enhancing its relationship with prime brokers, key liquidity sources in crypto markets. In May, Bybit began a compliance review of its dealings with prime brokers. Zhou emphasized the importance of knowing the prime brokers’ clients.

Bybit’s Growing User Base

Bybit has over 30 million users since its 2018 launch. Recent data shows a 24-hour trading volume of $2.9 billion, nearly half of Binance’s $6.3 billion. Bybit plans to open its first European office in The Netherlands in August.