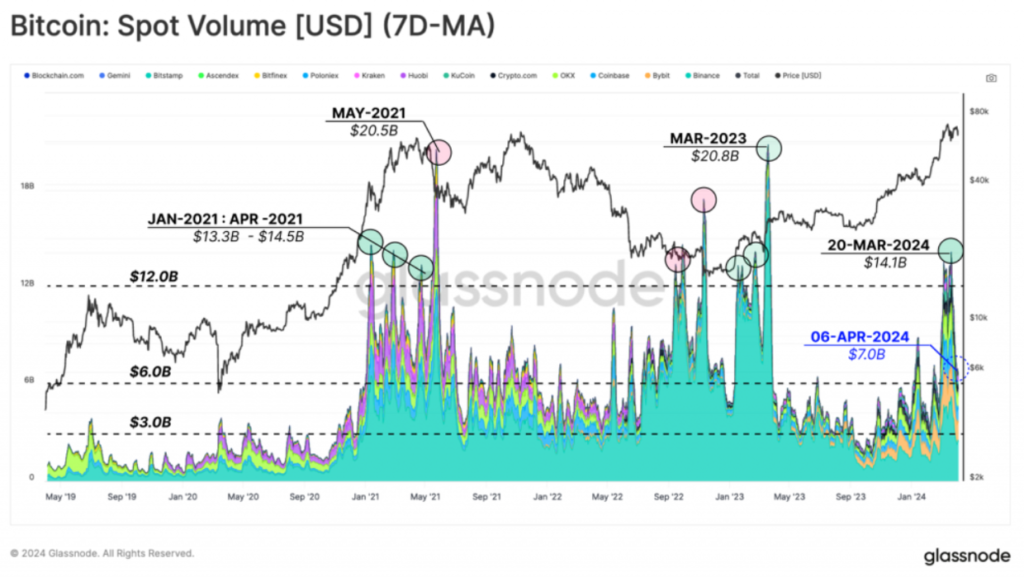

Following the historic peak reached in 2021, Bitcoin spot trading volumes surged to $14 billion per day according to CoinFactiva.com’s analytics. This year, the record-breaking surge was accompanied by a similar increase in trading activity. Another notable similarity lies in the attainment of “pre-euphoria” and “euphoria” zones, where the sustained profit-taking supply exceeds one standard deviation.

However, a fundamental difference between these two cycles is the driving force. In 2021, the main influx of investment came from institutional investors, while retail buyers actively utilized cryptocurrency exchanges, whose total reserves amounted to 2.9 million BTC.

This time around, retail investors are driving the main demand, with 30% of spot trading volume provided by new ETFs.

Meanwhile, cryptocurrency exchange reserves are steadily decreasing, reaching 1.94 million BTC. The visible impact of ETFs on spot trading is evident in the reduced market activity during weekends and US holidays when exchange-traded funds are not operational. Hence, it is evident that assessing Bitcoin’s future growth prospects should consider capital inflows into ETFs alongside traditional metrics.

Over the past two weeks, capital inflows have been significantly below the average at $203 million, with outflows observed in the last two days. This is primarily attributed to investors exiting the Grayscale fund, which imposes the highest management fee of 1.5%.

Additionally, ETF outflows in April have also been observed in the Ark Invest fund, with other ETFs recording a reduction in inflows. Coupled with the selling pressure from long-term holders and miners, this sets the stage for a correction.

Considering the similarity between the current cycle and that of 2021, a potential pullback of 30% within the “euphoria” zone is plausible. The target level from the peak is around $52,000.

Disclaimer

Be forewarned that the content within our website is presented in utmost sincerity and intended for informational purposes only. Any course of action undertaken based on this information is solely at the reader’s discretion, assuming full responsibility for their decisions. This content also does not seek to persuade or advise anyone to invest, as it does not offer financial or trading guidance. We urge you to exercise caution and conduct thorough research, seeking guidance from a skilled financial advisor, before engaging in cryptocurrency or securities investments.