Mt.Gox Refunds Set to Begin in Early July

On June 24, crypto exchange MtGox refund manager Nobuaki Kobayashi announced that repayments to former clients would start in early July. The total amount to be distributed is 162,100 BTC, valued at $10 billion.

Bitcoin Drops Below $60,000

Following the announcement, Bitcoin reacted with an 8% drop within the day, falling below the $60,000 mark.

Derivatives Market Hit Hard

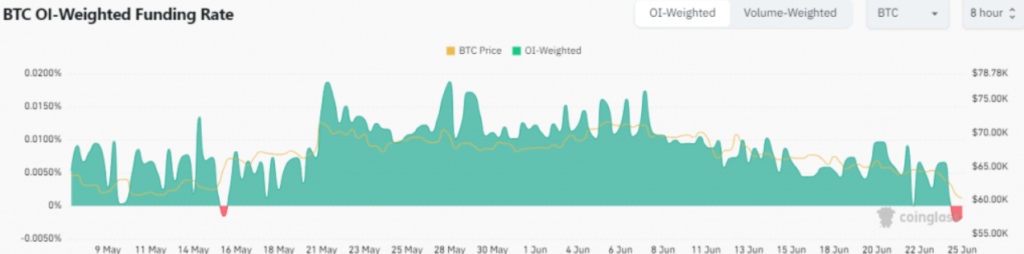

In the derivatives market, $177 million in bullish positions were forcibly liquidated. Additionally, the aggregate funding rate for futures contracts turned negative for the first time in June, indicating a predominance of selling over buying, as traders bet on further declines in Bitcoin’s price.

Impact of $10 Billion Sales

The reaction is understandable, given that potential sales amounting to $10 billion could significantly impact Bitcoin prices. By comparison, it took American spot ETFs three months to accumulate a similar amount, during which the cryptocurrency’s price surged by 71% to $72,800. Currently, cautious investors are rushing to exit, fearing a price crash.

Mitigating Factors

Staggered Payouts

However, the situation is not entirely bleak. The final deadline for repayments is October 31. If the payouts are spread evenly over four months instead of being made all at once, they would total $2.5 billion per month. This is roughly the same amount that long-term whale holders and crypto funds collectively sold in June.

Holding Strategy

Moreover, not all 162,100 BTC will immediately enter the market. Some former clients might hold onto their coins, anticipating further price increases.

Compensating Demand

The selling pressure will likely be partially offset by new demand. For instance, on June 20, MicroStrategy, the largest public holder of Bitcoin, purchased 11,900 BTC for $786 million. This acquisition brought their total holdings to 226,300 BTC, worth $14 billion, with an average purchase price of $37,000.

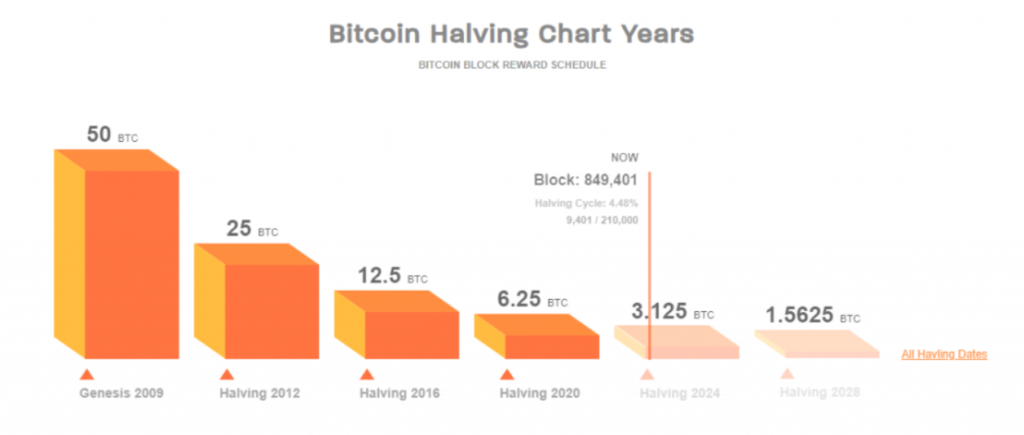

Halving Effect

Additionally, the Bitcoin halving event has reduced the annual coin issuance by 164,000 BTC, whose long-term effect will fully counterbalance the Mt.Gox payouts.

Long-Term Perspective

The extent of Bitcoin’s correction will depend on the Mt.Gox repayment schedule (details of which are still undisclosed), the willingness of recipients to cash out, and the market’s reaction to the news. In the long run, however, this event is unlikely to have a significant impact.