Growth of Crypto in CNWE

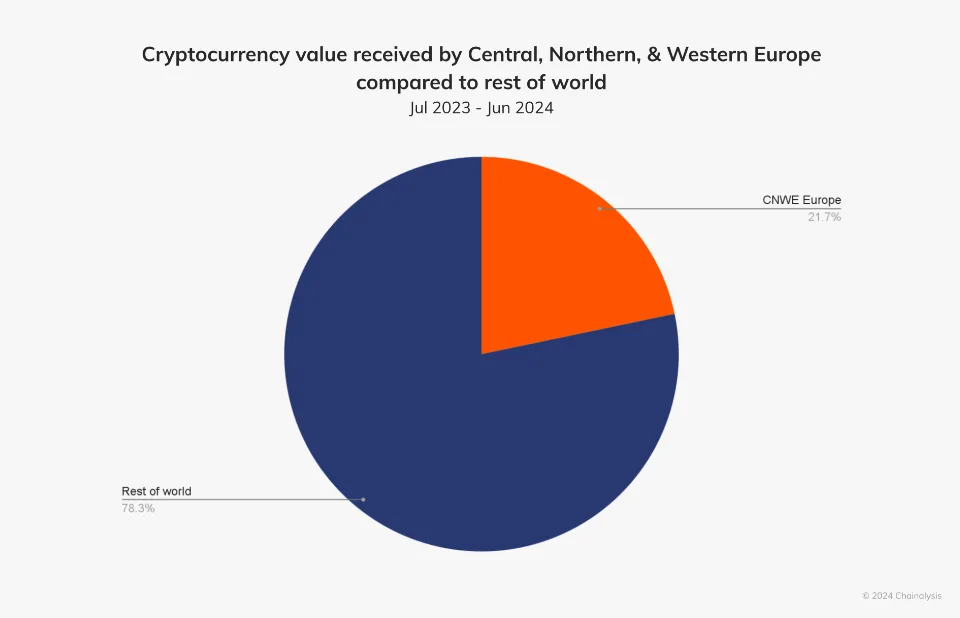

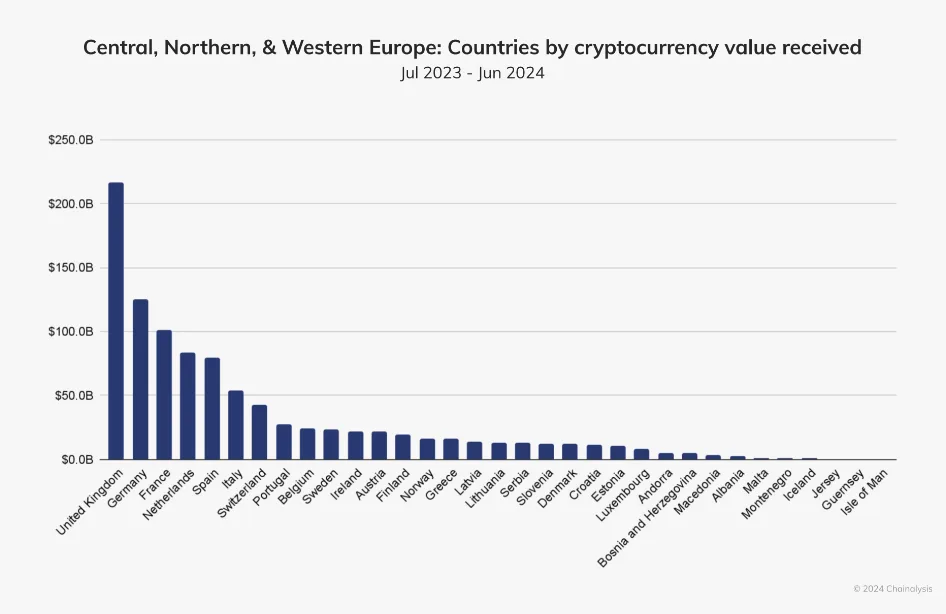

Central, Northern, and Western Europe (CNWE) is the second-largest cryptocurrency market after North America. From July 2023 to June 2024, CNWE received $987.25 billion in on-chain value, with a 44% growth rate across most countries. The UK leads the region, receiving $217 billion in crypto.

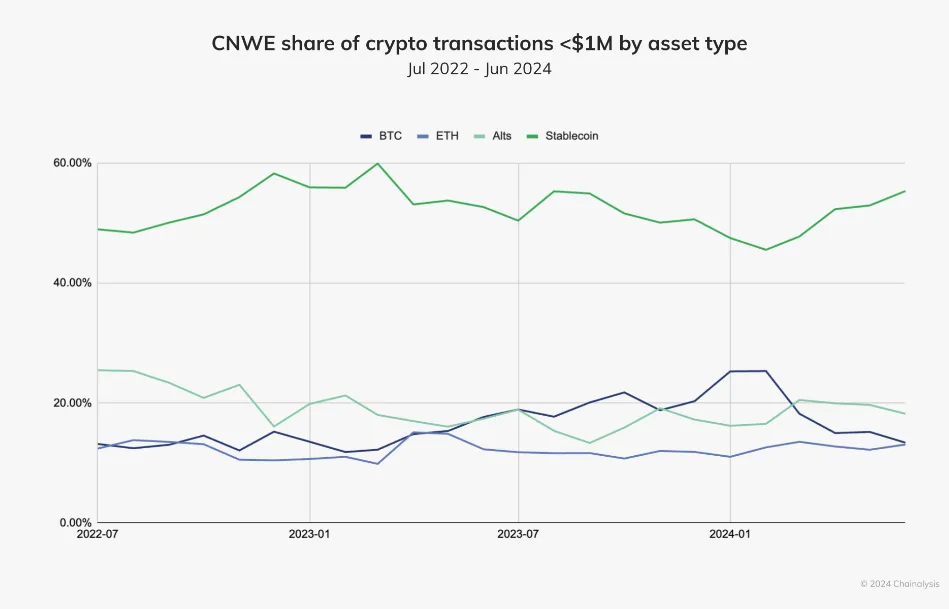

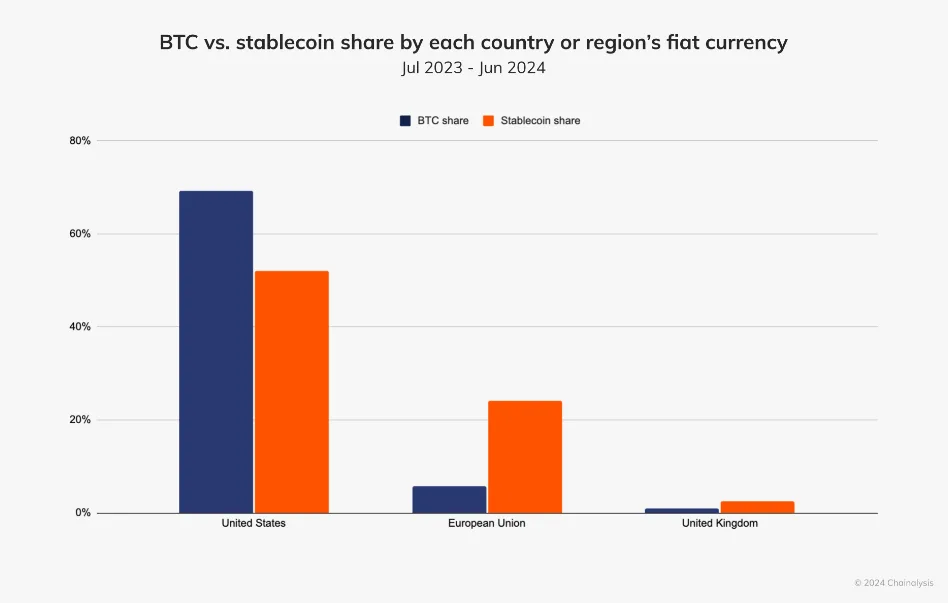

Stablecoins Drive Growth

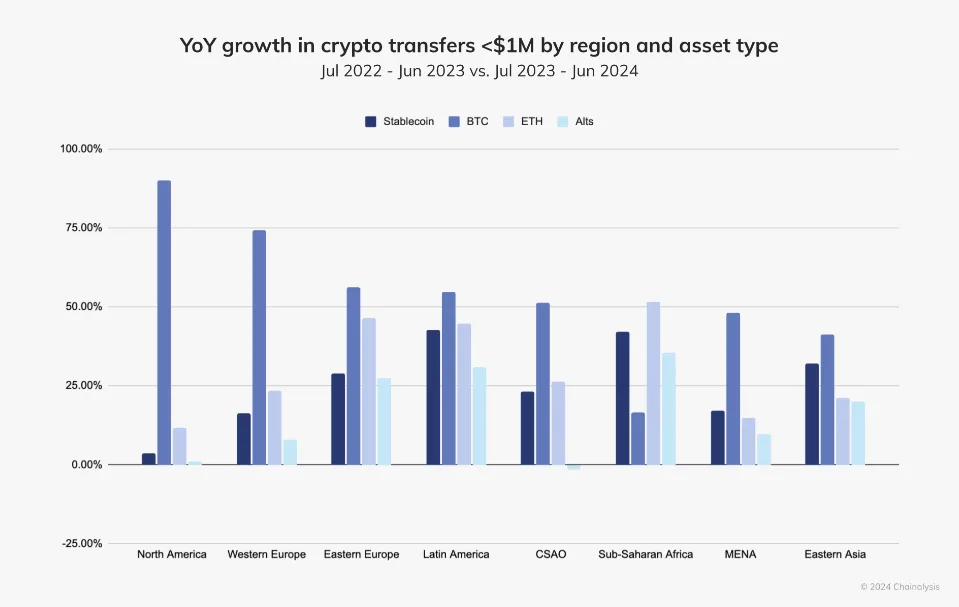

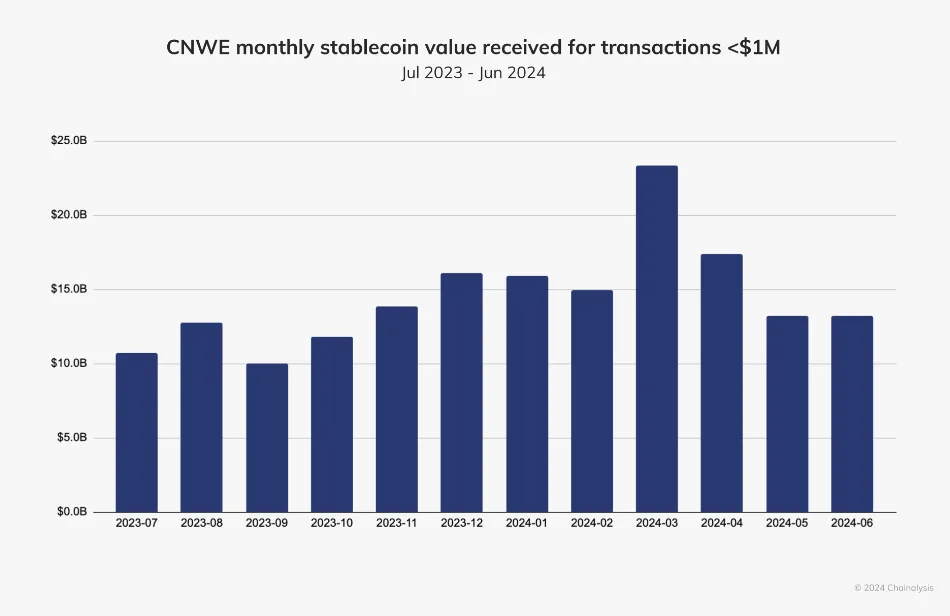

Bitcoin grew by 75% in smaller transfers but stablecoin volume surged even more. In transactions under $1 million, stablecoins in CNWE outpaced North America by 2.5x. Stablecoins accounted for almost half of CNWE’s total crypto inflows. Stablecoin transfers averaged $10-$15 billion monthly, reflecting their importance.

Merchant Services and B2B Payments

The UK drives CNWE’s merchant services, with 60-80% of its payments made using stablecoins. BVNK, a prominent provider, offers businesses solutions for payments, invoices, and cross-border transactions using stablecoins. Payments to contractors, especially in Latin America, are often done using stablecoins due to currency volatility.

Tokenization and Regulatory Outlook

Real-world asset tokenization is gaining momentum in Europe, particularly in real estate and art. With MiCA regulations rolling out, the EU is shaping its cryptocurrency regulatory framework. Experts anticipate growth in the stablecoin and tokenization sectors as regulatory clarity increases, unlocking more opportunities for innovation.

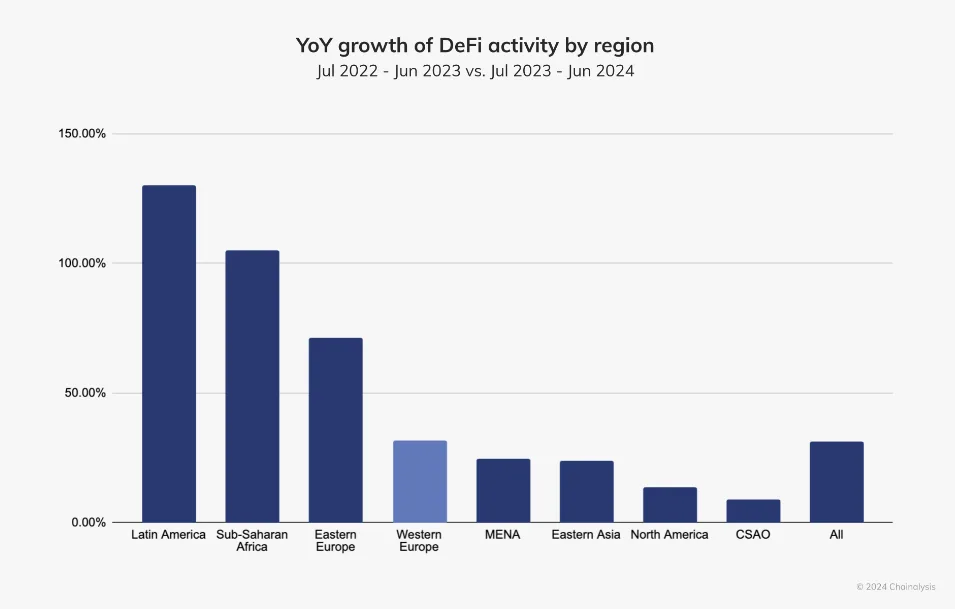

DeFi Growth in CNWE

DeFi activity in CNWE matched global trends, with decentralized exchanges driving growth. While NFTs and bridges surged briefly, they stabilized, and lending saw a temporary increase. CNWE’s DeFi growth outpaced other regions like North America and Eastern Asia, reflecting the region’s increasing prominence in crypto innovation.

Future Opportunities

As MiCA regulations begin to impact the stablecoin market, companies in CNWE will navigate new compliance challenges. Experts believe these regulations will boost innovation and growth, particularly in the stablecoin and DeFi sectors. Stablecoins will likely continue to be a dominant force in European crypto markets.