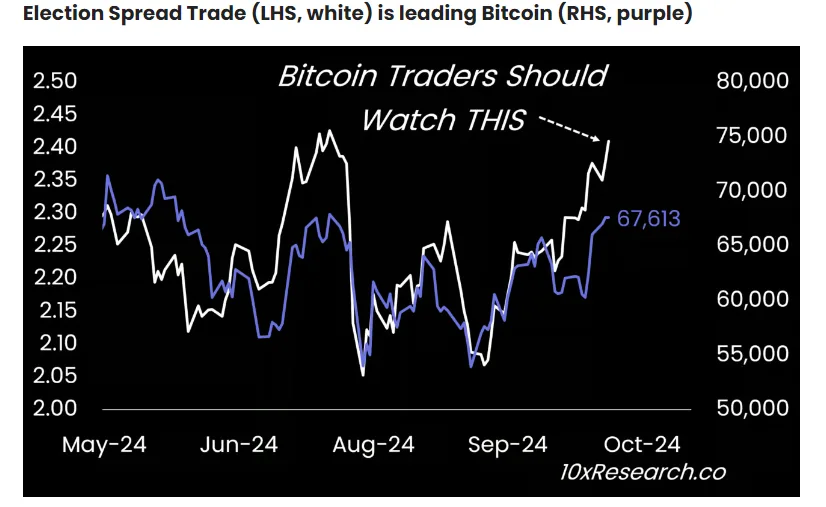

With the U.S. election looming, many are focused on Trump’s poll numbers. However, Bitcoin traders should look elsewhere for clearer signals. Institutional investors will likely wait for an official election outcome before making large moves, despite betting markets heavily favouring a Trump victory. Let’s explore the key data that should guide crypto market participants.

Polls Are Unreliable Indicators

Polls have historically underestimated Trump’s chances and may be manipulated by larger market players. Instead, traders should focus on how the market signals predict the outcome. Large traders often reveal more reliable clues than pollsters or betting platforms.

Trump’s Economic Impact

Trump’s pro-business reforms could push the Federal Reserve to alter interest rate policies. Rapid economic growth may lead to higher interest rates, influencing market trends. While tariffs remain a risk, their effects are likely to be delayed by negotiations.

Small-Cap Stocks Set to Surge

U.S. small-cap stocks are primed to gain if Trump wins, while bond yields could rise as Treasury bonds face a sell-off. A strategy pairing long small-cap stock positions with short bond positions might prove profitable, reflecting the financial market’s favoring of a Trump victory.

Market Volatility is Dropping

Election uncertainty is fading, as seen in the decline of the VIX index below 20%. This could pave the way for an upward shift in risk assets like Bitcoin, especially as Bitcoin volatility rises while equity volatility declines.

Bitcoin as a Direct Play

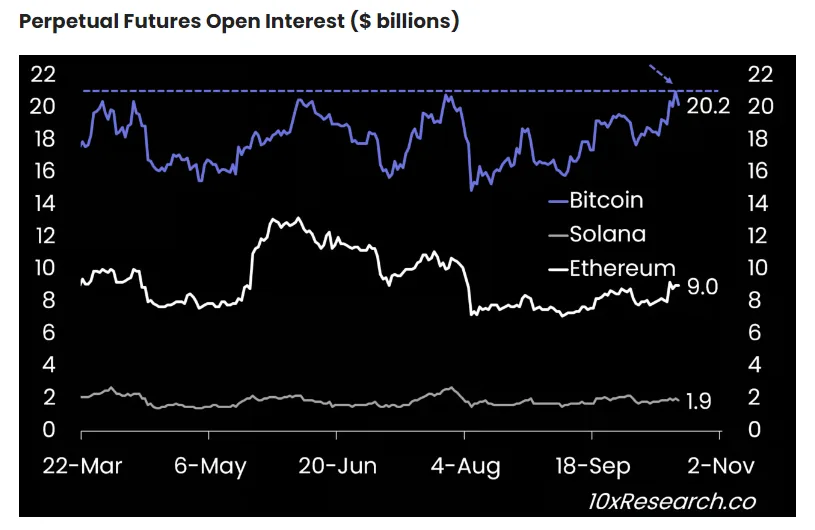

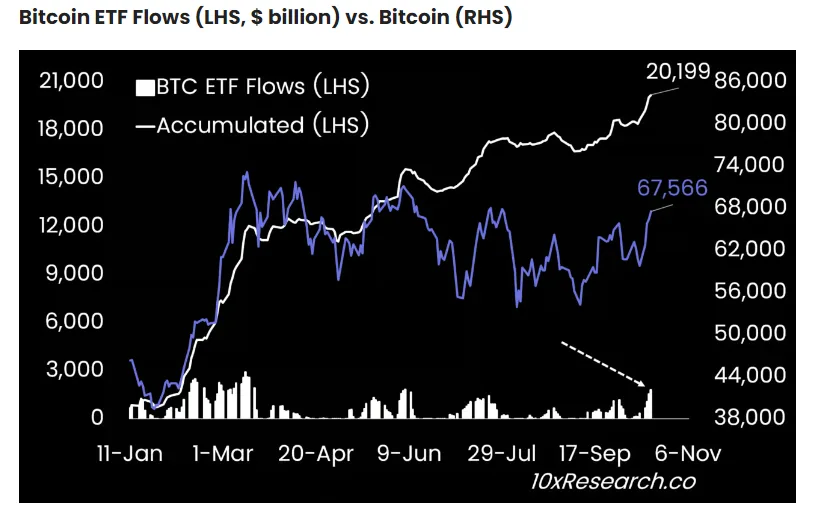

Rather than focusing on altcoins, Bitcoin provides a cleaner way to capitalize on market momentum. Traders are already positioning ahead of the election, with Bitcoin perpetual futures and ETFs showing significant interest.

Futures and ETF Inflows Surge

Bitcoin’s futures open interest has reached new highs, signaling strong market positioning. ETF inflows are also increasing, reflecting a solid long bias in the market. This aligns with the broader belief in a post-election Bitcoin rally.

Investor Sentiment Driving Bitcoin

With the election nearing, sentiment in Bitcoin is gaining strength, supported by ETF inflows and perpetual futures. The market is pricing in continued optimism, anticipating a Trump victory and further bullish momentum. Traditional polls and surveys are becoming less relevant, while financial market positioning becomes a more reliable indicator.

Conclusion

For Bitcoin traders, the real signals to watch are not the polls but the movements in market positioning. Institutional investors are gearing up for the election, and the momentum in Bitcoin is just beginning to rise. Keep an eye on key financial indicators, not political predictions, for insights into post-election market trends.