The Rise of Stablecoins

For widespread cryptocurrency adoption, a “killer app” is essential—something users can’t live without. According to a16z analysts, stablecoins have quietly become that killer app.

In Q2, stablecoins saw a transaction volume of $8.5 trillion, more than double VISA’s $4.0 trillion. PayPal, by comparison, managed just $0.4 trillion.

Transaction Volume vs. Transaction Count

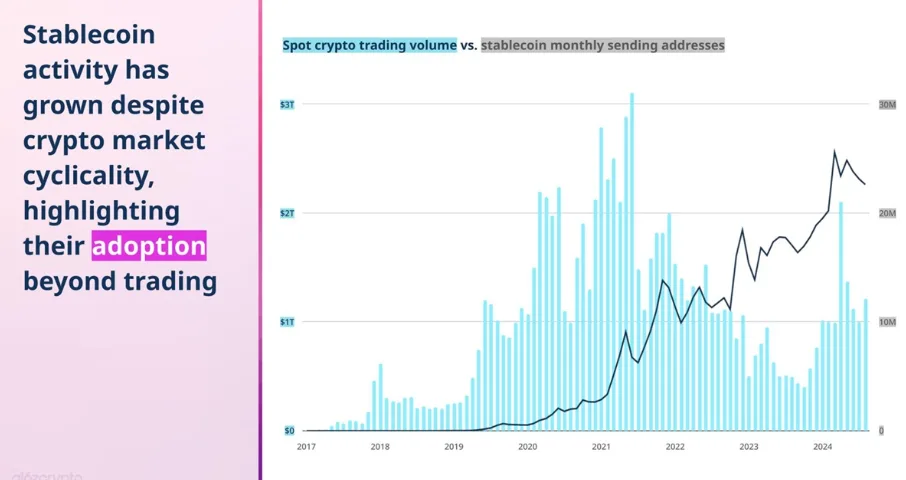

Although stablecoins lead in volume, they still lag behind in the number of transactions. However, the number of active monthly addresses continues to rise steadily, even during crypto market downturns. This indicates that stablecoins have moved beyond just bridging fiat and crypto. They are now widely used for payments and as a hedge against inflation in some developing countries.

Regulatory Clarity and Lower Fees

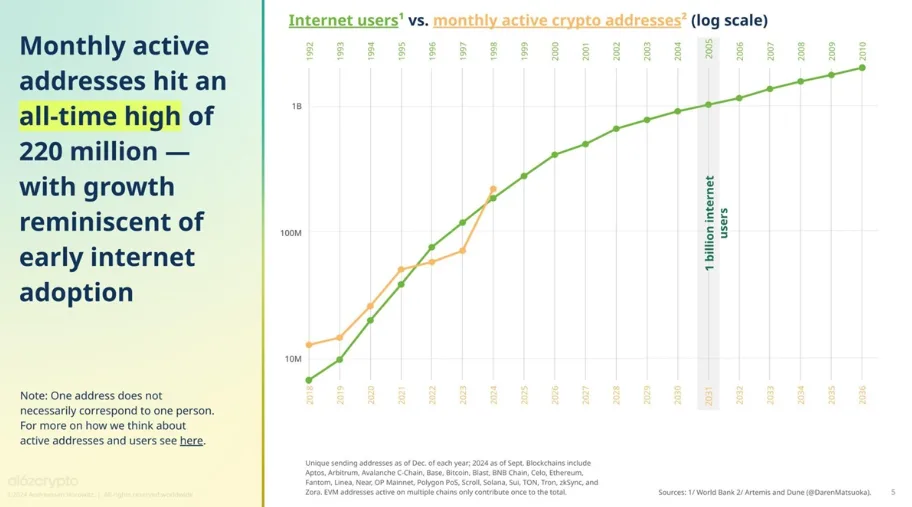

Adoption has also been driven by increased regulatory transparency, especially with the introduction of MiCA in the EU. The growth in crypto users and declining fees have further accelerated this trend.

Over the past year, active addresses tripled to 220 million. This growth mirrors the rise of internet users after the web’s launch.

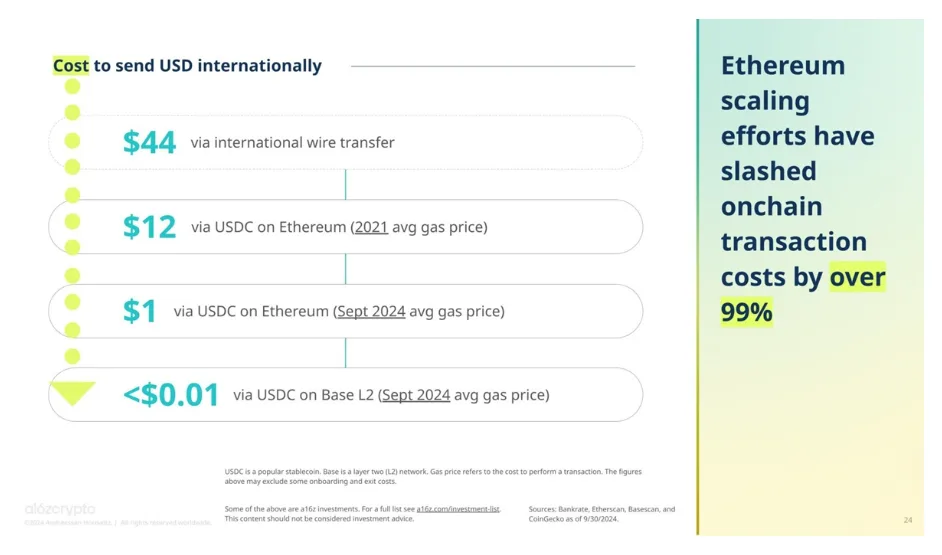

Falling Transaction Costs

One major factor is the sharp drop in transaction fees. In 2021, sending a stablecoin on Ethereum cost about $12. Now, the same transfer on Base (Coinbase’s Layer 2 network) costs less than a cent. This is thousands of times cheaper than traditional international payments through systems like Western Union or PayPal. Additionally, crypto transaction fees are flat, while traditional systems typically charge both a fixed fee and a percentage.

Bitcoin’s Role in Stablecoin Growth

Bitcoin’s rise and its solidified status as a commodity and investment asset in the world’s largest economy have also played a key role in stablecoin adoption.

Cryptocurrency institutionalization worldwide is now a matter of “when,” not “if,” and stablecoins are central to this trend.