Regulatory Pressure Under Biden

Under President Biden, the approach to crypto regulation has leaned heavily on fines and restrictions. This has been fueled by ongoing regulatory uncertainty. SEC Chair Gary Gensler has faced numerous challenges in Congress. Lawmakers have repeatedly failed to clarify the legal status of major cryptocurrencies like Ethereum. As a result, fines have surged from $1.3 billion in 2020 to $19.5 billion this year.

Trump’s Crypto-Friendly Stance

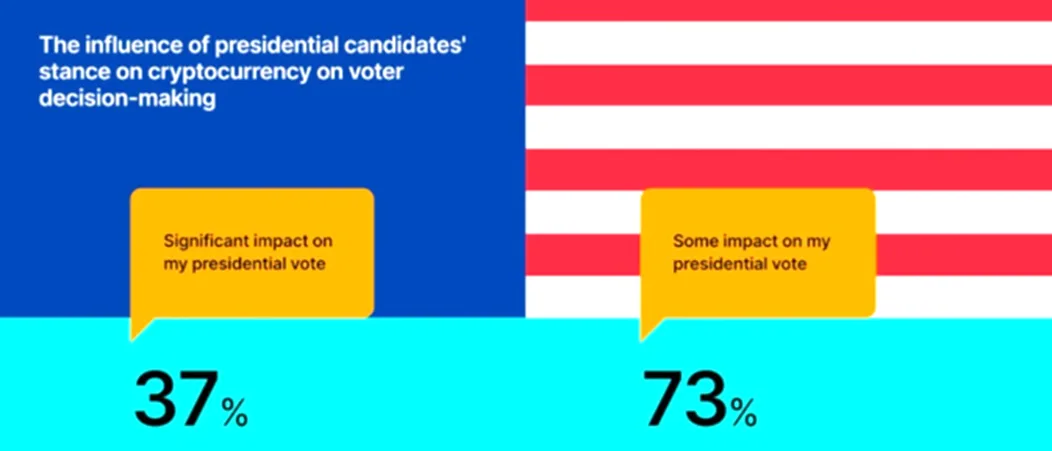

Former President Donald Trump, once critical of digital assets, has recognized the growing influence of the crypto community. His current campaign promises include easing regulations for miners, startups, and crypto investors, alongside pledges to fire Gensler on his first day in office. This shift in stance has proven effective. Polls show Trump gaining more support among crypto-enthusiastic voters than Kamala Harris. According to a Gemini study, 37% of voters consider a candidate’s crypto stance a key factor in their decision.

Kamala Harris’ Crypto Response

In response to losing ground, Vice President Kamala Harris promised on October 14 to significantly improve the regulatory framework for crypto. Bitcoin reacted immediately, jumping 5.1% by the end of the day.

Bitcoin in Election Year Trends

Historically, Bitcoin tends to be more cautious during election-year Octobers due to political uncertainty. However, “Uptober” typically shows stronger performance in the second half of the month. With Harris showing more flexibility toward crypto, we may see Bitcoin break past the $70,000 resistance level even before the election results are in.

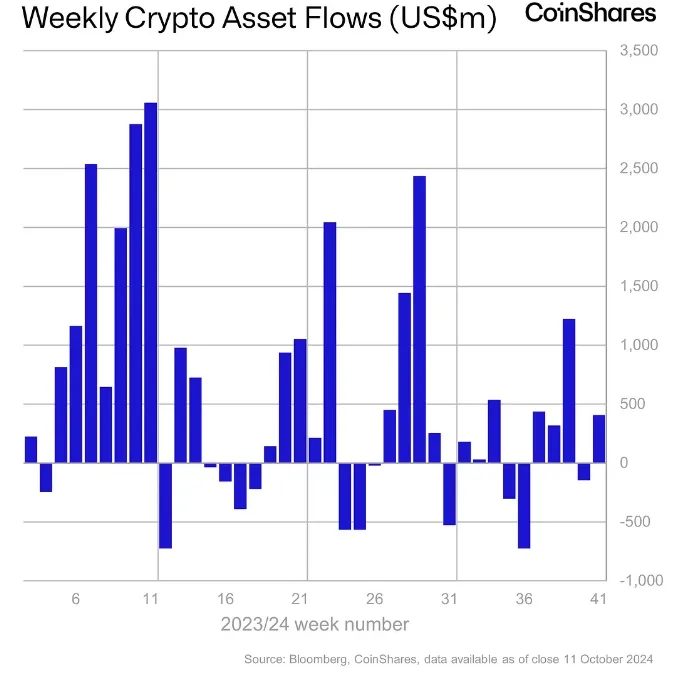

Crypto Fund Inflows Rise

Last week, net inflows into crypto exchange-traded funds (ETFs) reached $407 million. CoinShares attributes this return of investor confidence to political factors—specifically, growing optimism about Trump’s victory based on recent polls.