Patience is Key

Bitcoin and Ethereum traders are expected to see significant gains in the coming weeks. Analysts emphasize the need for patience, warning traders not to become complacent despite Bitcoin’s recent price stagnation. Though October is typically a bullish month, gains often come later. Bitcoin’s pattern of early-month lows might catch traders off guard, causing them to miss key breakouts.

Ethereum on the Rise

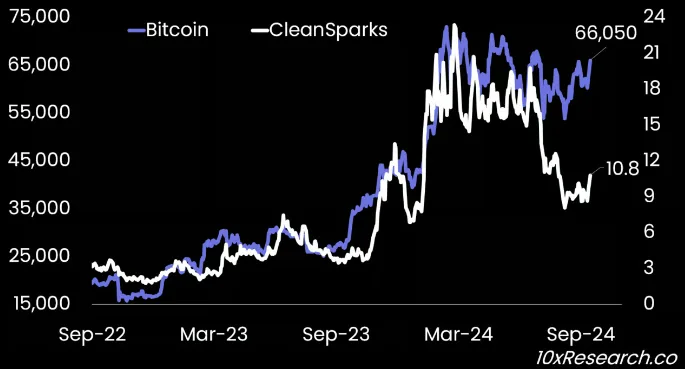

Ethereum’s outlook has improved as transaction fees in its network rise again. Since last week, Ether has gained 10%. Traders are also focusing on Bitcoin mining, with CleanSpark outperforming Bitcoin, surging 13% recently. Smart investors are positioning for the next 1-2 months.

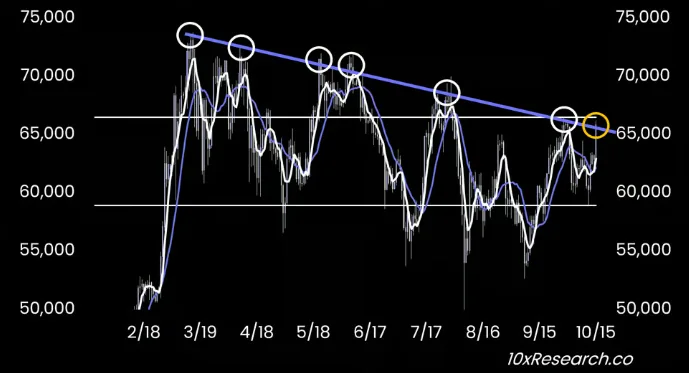

Bitcoin Eyes Breakout

The next 48 hours could be crucial for Bitcoin. Analysts predict a high probability of breaking through the seven-month consolidation line. Following the Federal Reserve’s September meeting, Bitcoin’s structural outlook turned bullish. October’s favorable conditions now increase the chance of a breakout.

Key Indicators Signal Reversal

Bullish weekly indicators have further boosted analysts’ confidence in a Bitcoin breakout. While short-term volatility may persist, these indicators suggest a potential for strong gains. Daily technicals, reset after a period of being overbought, make the fourth quarter a prime opportunity for profit.

Ethereum Targets New Heights

Ethereum could break above its $2,800 resistance level and aim for $3,000, thanks to a potential triangle breakout. Rising weekly fees in the Ethereum network have shifted sentiment, with traders preparing for upside potential.

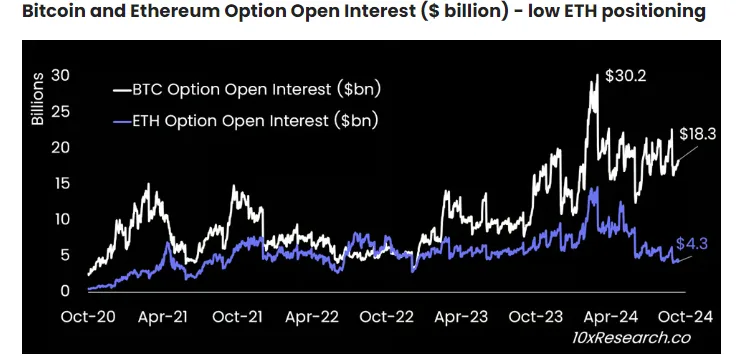

Traders Favor Optionality

As traders seek higher returns, Bitcoin’s implied volatility remains low. This presents a favorable risk/reward opportunity for upcoming catalysts. Open interest in Bitcoin options stands at $18.3 billion, indicating rising call buying and the possibility of a price surge above the $65,000 resistance level.

Ethereum Still Underestimated

Despite Ethereum’s growing potential, its outstanding options have dropped from $12.5 billion in March to just $4.3 billion. Implied volatility for Ethereum remains slightly higher than Bitcoin’s, but the market’s preference for puts could shift, adding further upside for Ether.

Catalysts Ahead for Bitcoin and Ethereum

Several events could drive Bitcoin and Ethereum prices higher in the coming months. Analysts expect that BlackRock will increase its promotion of Ethereum as part of its digital asset strategy. Meanwhile, central banks worldwide are cutting rates, boosting liquidity and creating a prime environment for gains.

U.S. Election’s Impact on Markets

With the U.S. Presidential election approaching, money market funds hold $6.5 trillion in cash reserves. As the Federal Reserve delays rate cuts, both stock and crypto investors may rush to capitalize on this unique opportunity, pushing markets higher.