Introduction

At the end of June, the European regulation MiCA came into force. This regulation is expected to shake up the stablecoin market in the coming months.

Exchange Announcements and Restrictions

Several exchanges have already announced restrictions on trading stablecoins for European Economic Area (EEA) users. They are considering delisting non-compliant stablecoins.

Growth of EUR-Backed Stablecoins

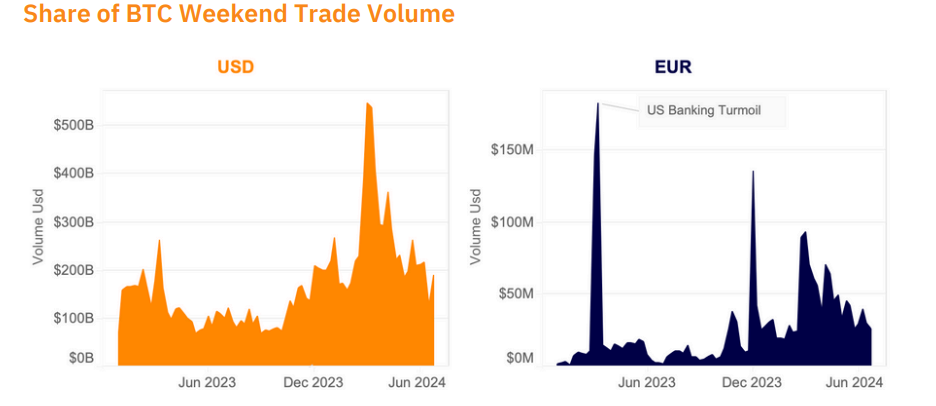

Despite traditionally lagging behind USD-backed stablecoins, EUR stablecoins have seen robust growth in volume this year. This growth indicates rising demand in European markets.

Q2 Volume Statistics

In Q2, the combined weekly volume of several EUR stablecoins averaged $42 million. This volume is double the 2023 average. The stablecoins included are Tether’s EURT, Stasis EURS, Société Générale’s EURCV, Anchored’s AEUR, and Circle’s EUROC.

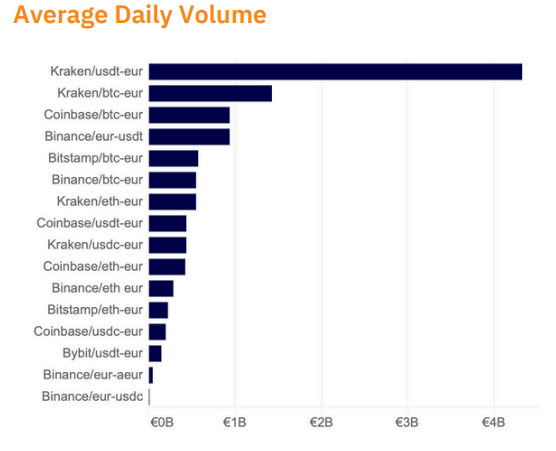

Potential Delisting of USDT

Exchanges have yet to announce which stablecoins will be considered unauthorized. However, Tether’s USDT will likely be included. USDT/EUR trading pairs currently have among the highest volumes. This indicates that these exchanges are crucial fiat offramps for EU traders.

Future Alternatives for Traders

While over-the-counter (OTC) trading will continue to provide USDT-EUR liquidity, many traders may switch to regulated alternatives like USDC.