Historical Trends

According to crypto analysts from ICO Rocket, in recent months Bitcoin has shown significant volatility. This is typical for the cryptocurrency market. Historical data suggests an interesting pattern. When Bitcoin has a negative June, it tends to bounce back strongly in July. The average return is 7.98%, with a median return of 9.6%.

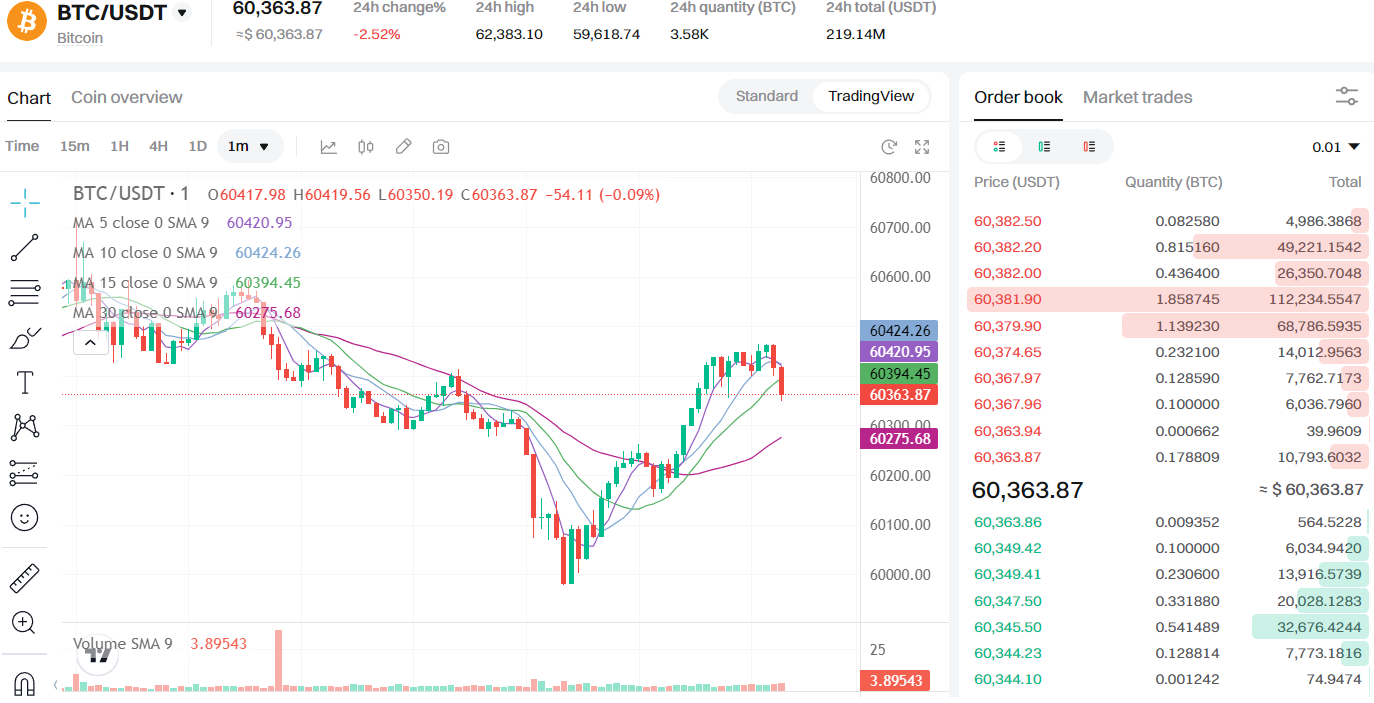

Current Market Levels

Currently, Bitcoin’s support level is around $58,000, with resistance at approximately $65,000. Predictions about its behavior in July and August can be made based on this data.

Macroeconomic Influences

The macroeconomic situation plays a crucial role. Inflation and interest rates in major economies, like the US and the Eurozone, impact the cryptocurrency market. High inflation might increase investors’ interest in Bitcoin as a store of value. Moreover, regulatory decisions are closely watched. Announcements about tightening or easing regulations can significantly influence Bitcoin’s price.

Technological Updates

Technological updates are also crucial. Enhancements like the Taproot upgrade improve the network’s functionality and security. These upgrades attract investor interest and can impact Bitcoin’s value.

Impact of Mt. Gox

Another important factor is the impact of Mt. Gox. The anticipated release of Bitcoin linked to the Mt. Gox exchange in the coming months could exert significant pressure on the market. Mt. Gox, one of the first and largest cryptocurrency exchanges, went bankrupt in 2014. It is set to return approximately 141,000 bitcoins to its creditors. This could lead to a decrease in Bitcoin’s price if creditors decide to sell their assets.

Possible Scenarios

Considering these factors, ICO Rocket traders think, that several scenarios are possible. In an optimistic scenario, favorable macroeconomic conditions and positive news from the cryptocurrency market could keep Bitcoin above $60,000. It might even push past $65,000. Conversely, in a pessimistic scenario, negative macroeconomic factors, increased regulatory pressure, or large-scale sales by whales could push Bitcoin down to $58,000 or even $55,000.

Conclusion

It is important to note that overly optimistic news and statements in the market often prove inaccurate. This highlights the need for caution. Given the current market situation and external factors, Bitcoin could fall to $58,000 – $55,000 in July and August 2024. However, this is not the dominant scenario.