The market has shifted from hopes of an altseason to a widespread sell-off of mid and small-cap coins. According to CoinFactiva.com analysts, as major projects are excluded, the correction from March levels becomes increasingly severe:

- Excluding Bitcoin: 20%

- Excluding Bitcoin and Ethereum: 25%

- Excluding the Top 10: 40%

Decline in Market Sentiment

The overall decline in sentiment is tied to a decrease in investment inflows into cryptocurrencies. For instance, American spot Bitcoin ETFs have seen a significant slowdown in inflows since March, with a $1 billion outflow recorded since June 7.

Interest from Large Capital and Venture Investments

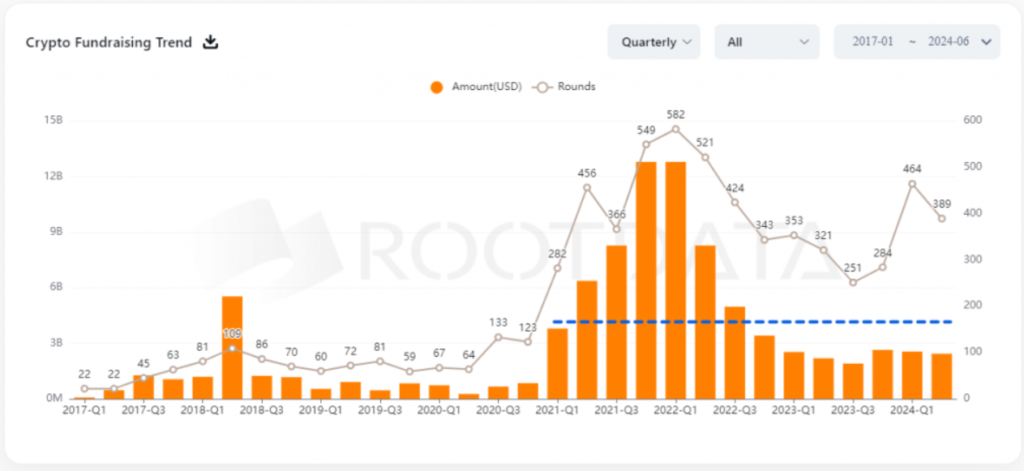

CoinFactiva.com analysts think that, interest from large capital directly in altcoins can be gauged through venture investments, which have shown no signs of revival since 2023. In the first quarter of 2024, startups attracted $2.5 billion, compared to $3.8 billion in the same period in 2021.

The downturn in 2022 taught investors to evaluate risks and long-term prospects of cryptocurrencies more cautiously. Some projects have worsened their positions by making strategic planning mistakes.

Strategic Missteps and Market Reactions

In March, we reported on Avalanche’s questionable decision to invest part of its funds in meme coins, pandering to the latest trends. The reaction was swift: the coin’s value halved to $24 since then.

Factors Undermining Interest in Altcoins

Frequent platform hacks, failure to meet previously made commitments, and the increase in circulating supply due to token unlocks are also undermining interest in altcoins. For example, Avalanche releases an average of 60,000 AVAX ($1.5 million) from restrictions daily.

Most of the unlocked funds enter the market as early investors prefer to lock in profits and move into more promising areas such as artificial intelligence. In 2024, NVIDIA’s stock has risen 2.5 times, a growth rate in the crypto sector matched only by newly minted or meme coins, which carry significantly higher risks.

Temporary Downturn and Future Prospects

However, analysts from CoinFactiva guess that, the current downturn is temporary. Bitcoin typically experiences a lull with a correction bias for 4-6 months post-halving, and altcoins struggle to show growth without significant positive events. The situation could improve as early as next week, as several experts anticipate the approval of spot ETFs for Ethereum on July 2. This event could underscore the significance of altcoins and their integration into the traditional financial system.