Solana Aims for Top 3

The “Ethereum Killer” is realizing its potential, surpassing its main competitor in stablecoin turnover and attracting significant institutional interest. However, frequent outages and a high rate of failed transactions remain obstacles to its growth.

Since December, Solana has shown active growth in stablecoin turnover, reaching $1.5 trillion in April. For comparison, Ethereum handled $0.9 trillion, and Tron $0.4 trillion over the same period. Although much of this turnover is driven by arbitrage bots, it doesn’t diminish Solana’s success as a financial operator.

Pros

Solana also outpaces Ethereum in integration into the traditional financial system. For example, the trading platform Robinhood is launching its first staking program for clients on Solana. Due to the SEC’s negative stance on passive income in the crypto space, this service will only be available to European users.

In 2023, in collaboration with VISA, Solana launched a pilot project for interbank exchanges in USDC and, through a partnership with the e-commerce platform Shopify, conducted $20 million worth of transactions.

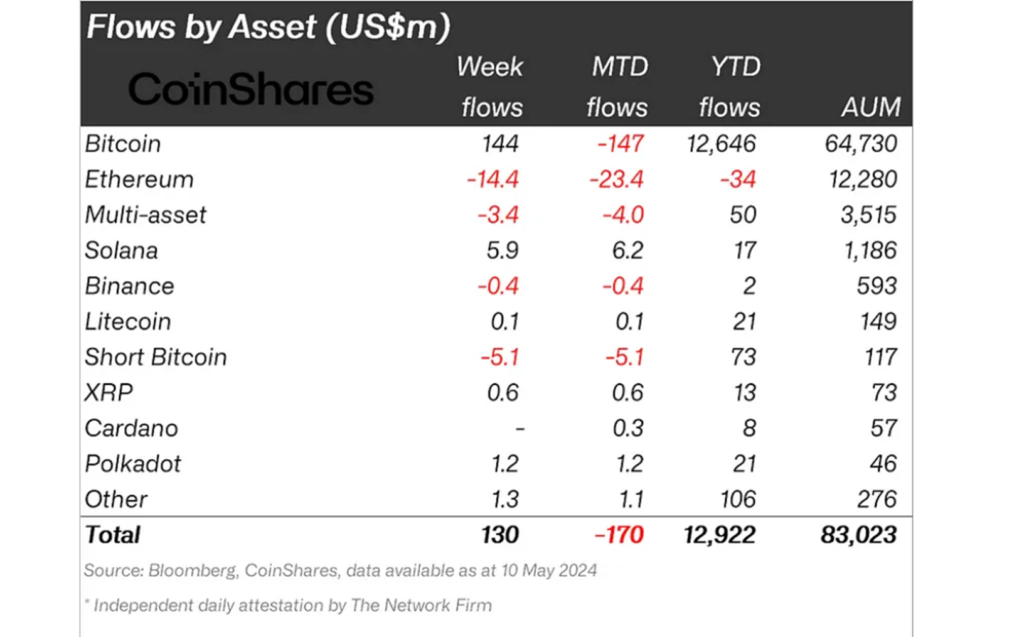

Solana is more attractive to institutional investors, with $17 million invested in crypto funds related to it over the past year, while Ethereum experienced a $34 million outflow during the same period.

Solana’s advantage lies in its high transaction speed and extremely low fees. With the deployment of the Firedancer client-validator, its throughput capacity is expected to leave competitors far behind, scheduled for mid-2024.

Cons

Both cryptocurrencies, Ethereum and Solana, face similar regulatory pressure in the US, with the SEC labeling both as “securities.”

Despite its promising outlook, Solana faces periodic outages and a high rate of failed transactions due to heavy congestion. The team is working on solutions, including transaction ranking and fee increases for “abusive” transfers.

Conclusion

If Solana can resolve these issues, it is poised for success. Major investment firms like Franklin Templeton, with $1.6 trillion in assets under management, highly rate Solana’s chances of reaching the third spot in the overall cryptocurrency rankings. VanEck ($60 billion AUM) projects a base scenario where Solana’s price could rise to $335 by 2030.