Factors Behind Ethereum’s Decline in May: For the third consecutive year, Ethereum has lagged behind Bitcoin in performance, dropping by 13% since January alone. Two significant factors indicate that this trend may intensify in May. This year, the primary catalyst for Bitcoin’s growth has been the introduction of spot ETFs in the United States, which have attracted $11.7 billion in investments over five months.

Investors in Ethereum are anticipating a similar surge, as May 23 marks the deadline for the review of VanEck’s application to launch a spot ETF.

For the SEC to reject this, it will need to find a compelling argument; otherwise, the regulator will be put in an uncomfortable position, as was the case with Grayscale’s application last year.

As one stumbling block is the staking participation program, Ark Invest and 21Shares recently amended their proposal, excluding this option for ETF investors. However, most experts agree that this will not help the case.

The SEC has shown extremely negative sentiment towards Ethereum after its transition to the PoS algorithm, as Chairman Gary Gensler informed the public on the same day. In his view, Ethereum should not be treated as a commodity (like Bitcoin) but as a security. This imposes a completely different set of requirements on ETF managers and investors alike.

One indirect indication of the SEC’s rejection in May is the lack of negotiations with applicants. Before launching Bitcoin ETFs, regulator representatives met with potential managers several times a week for a month and a half.

The SEC’s rejection will prompt Ethereum sell-offs, as some investors become disillusioned with its prospects.

Inflation

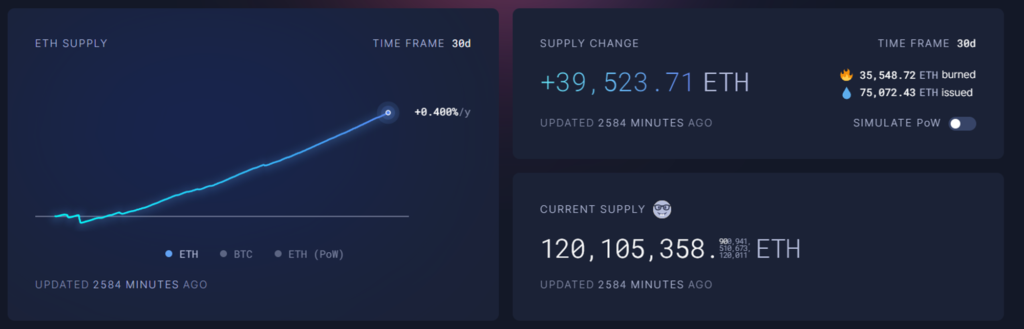

After the London hard fork and the implementation of the burning mechanism, Ethereum became deflationary. In simpler terms, the number of destroyed coins began to exceed the issuance of new ones. All else being equal, this is a growth factor for any asset. The effect intensified after the transition to PoS.

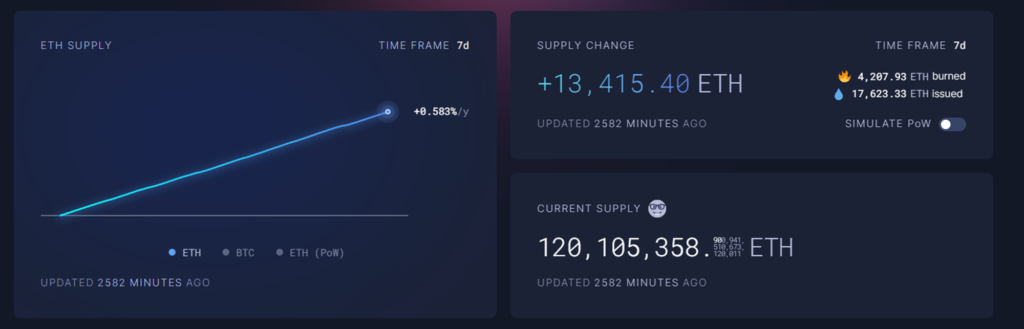

However, widespread staking enthusiasm and low network activity led to an undesirable outcome – inflation prevailed again. Over the past month, the inflation rate has reached 0.4% and for last 7 days it grew even to 0.583%.

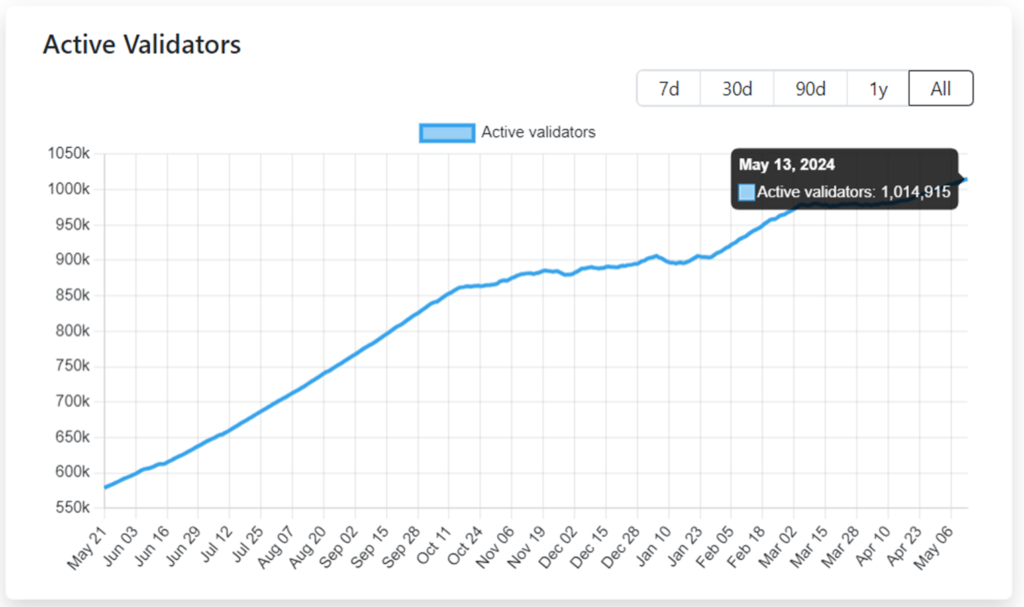

The number of active validators (who need to be rewarded) has exceeded 1 million, which is more than enough for the network to operate stably and securely.

Further influx will only cause congestion due to the increase in technical messages. The algorithm for reducing rewards based on the number of validators proved to be insufficiently flexible, prompting developers to consider forced reward reductions.

Meanwhile, network activity, which led to increased coin burning, has decreased due to a shift in interest towards L2 and L3 networks. In simplified terms, users have become more active in Base or Arbitrum, from which transactions to Ethereum are compressed.

According to CoinFactiva.com analysts, as these trends gain traction, Ethereum inflation is likely to persist for a long time. It will have a long-term negative effect on the cryptocurrency’s value, and coupled with the SEC’s rejection, will lead to an increase in the gap in performance compared to Bitcoin.

Disclaimer

Be forewarned that the content within our website is presented in utmost sincerity and intended for informational purposes only. Any course of action undertaken based on this information is solely at the reader’s discretion, assuming full responsibility for their decisions. This content also does not seek to persuade or advise anyone to invest, as it does not offer financial or trading guidance. We urge you to exercise caution and conduct thorough research, seeking guidance from a skilled financial advisor, before engaging in cryptocurrency or securities investments.