The launch of spot Bitcoin ETFs in Hong Kong marks a new milestone in the history of the cryptocurrency market, signaling increased recognition and adoption of Bitcoin. These ETFs have the potential to become a focal point for Asian investments.

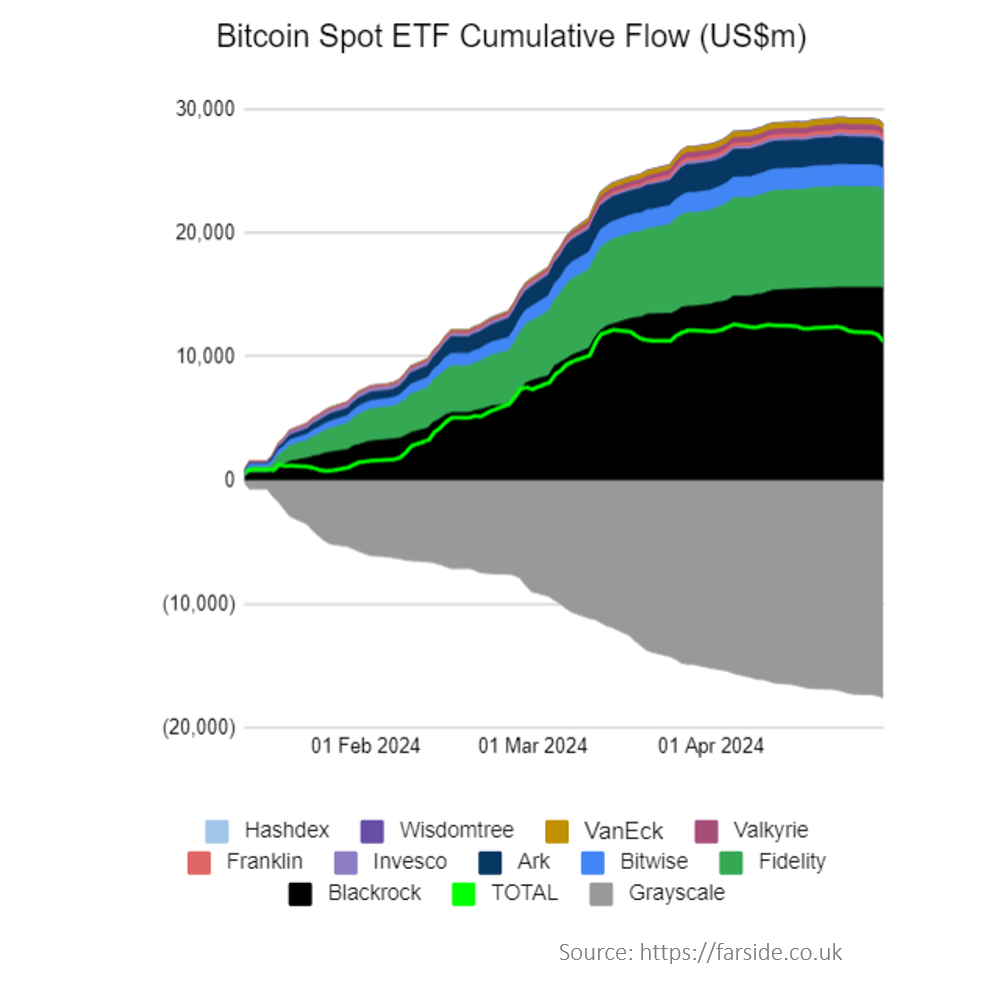

This year, the launch of similar crypto funds in the US has been a major driver of the crypto market, resulting in a net inflow of $12 billion and causing Bitcoin’s value to rise by 37% to $63.3 thousand. BlackRock’s fund has shown the best performance, gathering investments worth $15.5 billion, while Grayscale, whose fund was converted from a trust, experienced outflows of $17.2 billion. Three months later, Grayscale, despite initially charging significantly higher fees than its competitors, announced the imminent launch of a mini version of its fund. In the new fund, the management fee will be 0.15%, compared to the average 0.25% among competitors and 1.5% for its flagship GBTC. The team hopes this will halt the daily outflow of funds.

BlackRock and Fidelity‘s funds were the fastest-growing ETFs globally in the first quarter. Zhu Haokan, Executive Director of China Asset Management (one of the Hong Kong ETFs), believes that the turnover of Chinese products on the first day of trading could overshadow their American counterparts. A key advantage will be conducting settlements in kind, whereas the SEC in the US only allows cash settlement.

Independent estimates of the ability of Hong Kong ETFs to accumulate investments vary widely, averaging between $0.5 billion and $2 billion in the first year. This low forecast is due to the inability to attract significant capital from mainland China due to restrictions imposed on organizations as early as 2021.

The main hopes lie with institutional players from Asia, as the domestic market in Hong Kong does not make a strong impression. Existing ETFs on crypto futures manage a modest $170 million, while in the US, BITO alone operates with $2.8 billion. Given the arguments above, it is unlikely that the launch of ETFs will have a noticeable impact on the cryptocurrency’s price in the coming days. However, the mere fact of the introduction of exchange-traded products with Bitcoin worldwide is an extremely positive sign for the industry. Recently, Bloomberg reported, citing an anonymous source, that spot Bitcoin ETFs may appear in Australia this year. This would be a significant step towards global recognition of Bitcoin.