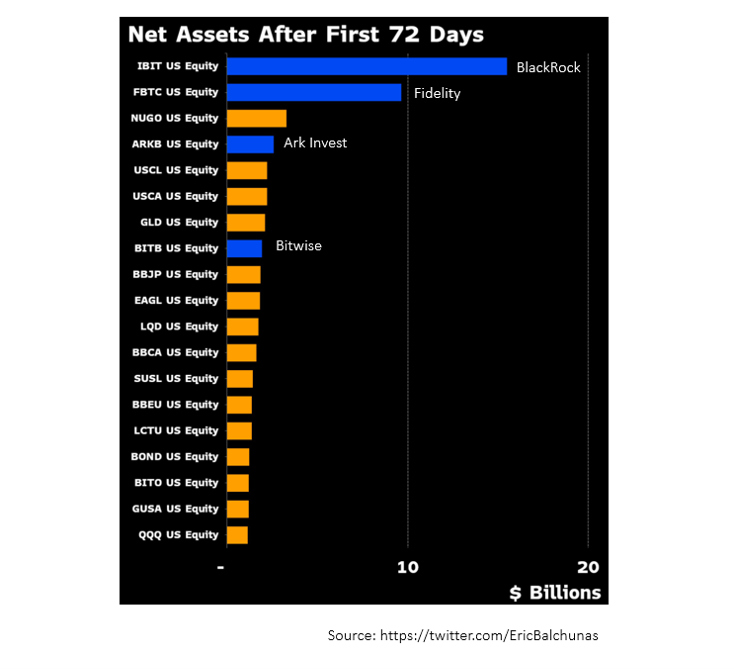

The growth of Bitcoin is driven by China, not ETFs. The spotlight in cryptocurrency news over the past six months has focused on the approval of spot ETFs in the US and the subsequent record inflow into BlackRock and Fidelity funds. In less than 72 days of operation, they became the fastest-growing ETFs globally, collectively amassing $23.7 billion.

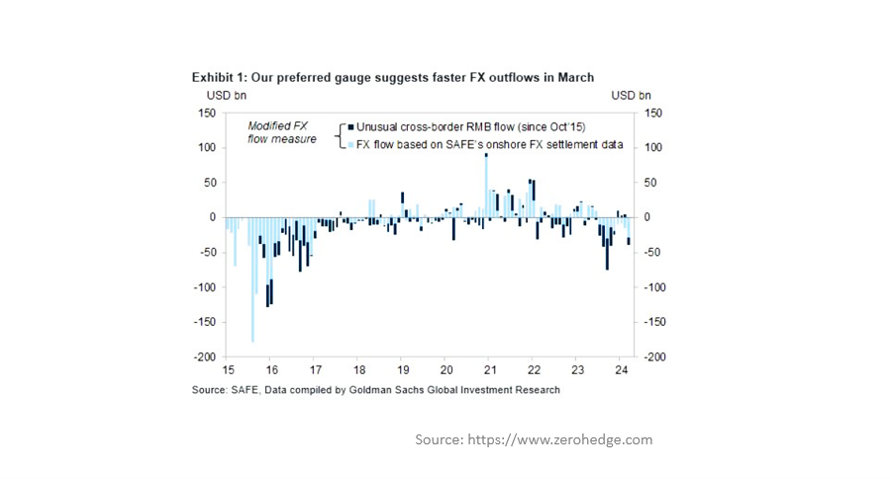

Analysts at CoinFactiva argue that the primary driver behind Bitcoin’s surge was not the launch of ETFs but rather the currency outflow from China. In October 2023, it reached its highest level since 2015, totaling $75 billion. At that time, Bitcoin was trading at $27,000 and surged 2.7 times in six months. In March 2024, the currency outflow regained momentum, reaching $39 billion.

Chinese citizens face strict restrictions on the withdrawal and use of money abroad. For instance, obtaining separate permission is required to carry a cash sum exceeding $5,000 out of the country. Additionally, ATM withdrawals abroad are limited to ¥100,000 per year (~$13,800). Consequently, cryptocurrency has become a priority instrument for many.

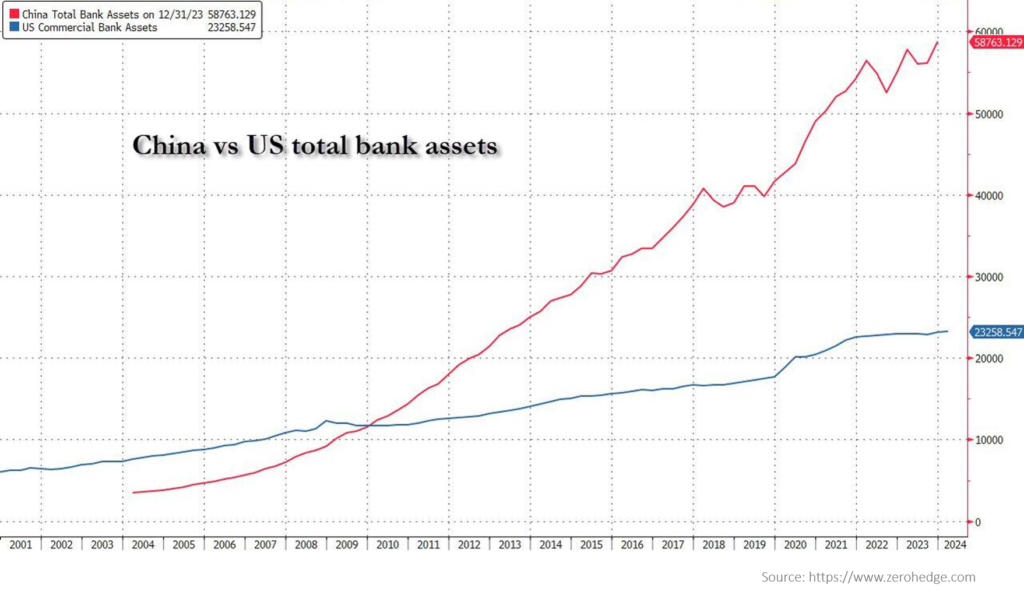

Apart from the desire to surpass limits during travel, interest in Bitcoin is fueled by the devaluation of the yuan, prolonged stock market declines, and real estate market crises. China’s investment potential is significant, with capital volume nearly three times that of the US.

The only hindrance to investments is the ban on financial institutions within China conducting cryptocurrency operations. Therefore, investors are forced to seek alternative routes and turn to the P2P market.

Despite these challenges, Zerohedge believes that with the continued pace of currency outflow from China, Bitcoin will double in the next six months.

BitMEX co-founder Arthur Hayes shares a similar perspective, emphasizing the imperfections of the entire modern financial system and the steady devaluation of national currencies.

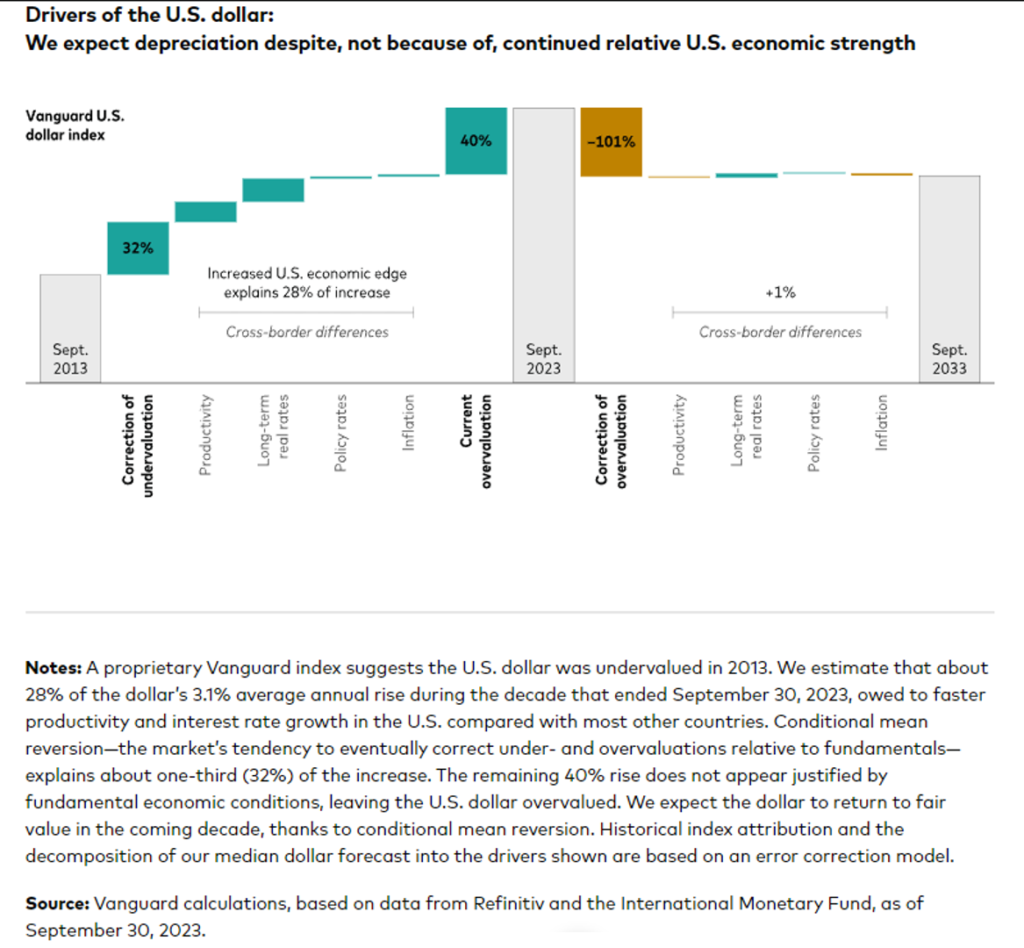

Hayes predicts that fiat money will be printed indefinitely until the system resets. He further notes that the US will ramp up money printing despite the growing gap between revenues and government spending. This year, the imbalance will expand due to expenditures on foreign policy, defense, and presidential elections.

This will inevitably lead to the weakening of the US dollar against “hard” assets like gold or Bitcoin. According to Hayes, cryptocurrency will reach $1 million in the foreseeable future.