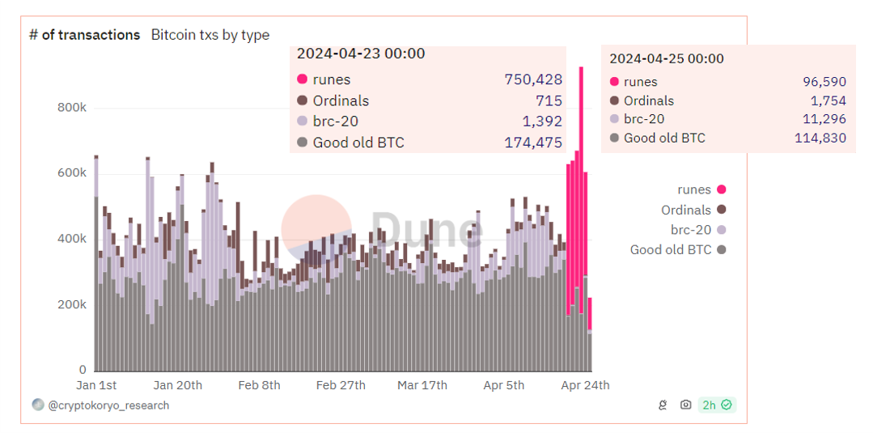

Crypto funds have seen outflows for the second consecutive week. The recent halving saw a surge in fees due to the implementation of the Runes protocol in the same block, enabling the minting of a new subtype of meme coins.

Speculative frenzy remains high – Runes account for about half of all transactions in the block, causing the fee for a simple transaction to exceed $15.

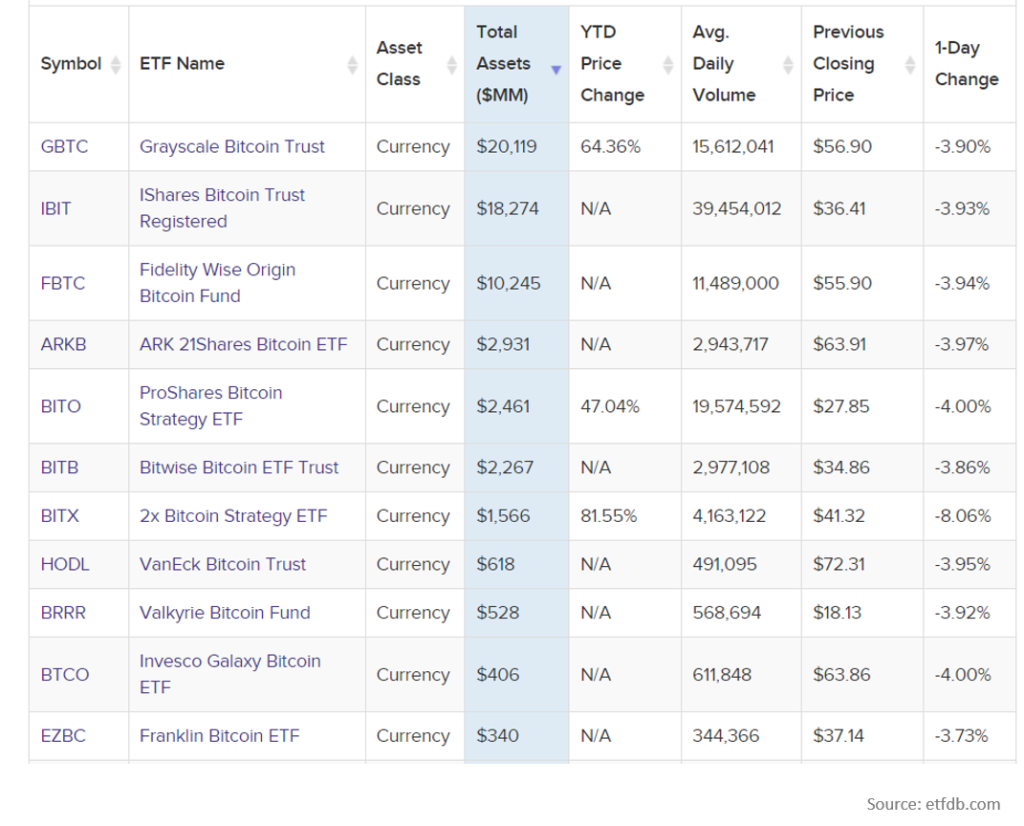

However, investment interest in Bitcoin has remained subdued over the past two weeks.

Crypto funds, which were driving the cryptocurrency market earlier this year, have demonstrated outflows for two consecutive weeks. During this time, their aggregate balance has decreased by more than $330 million. On the first trading day after the halving, inflows into spot ETFs were modest at $62.2 million.

Investor caution is linked to the price record set before the halving (a first in history) and the forecast by several analysts led by JPMorgan of an inevitable correction towards $50,000 due to inflated expectations.

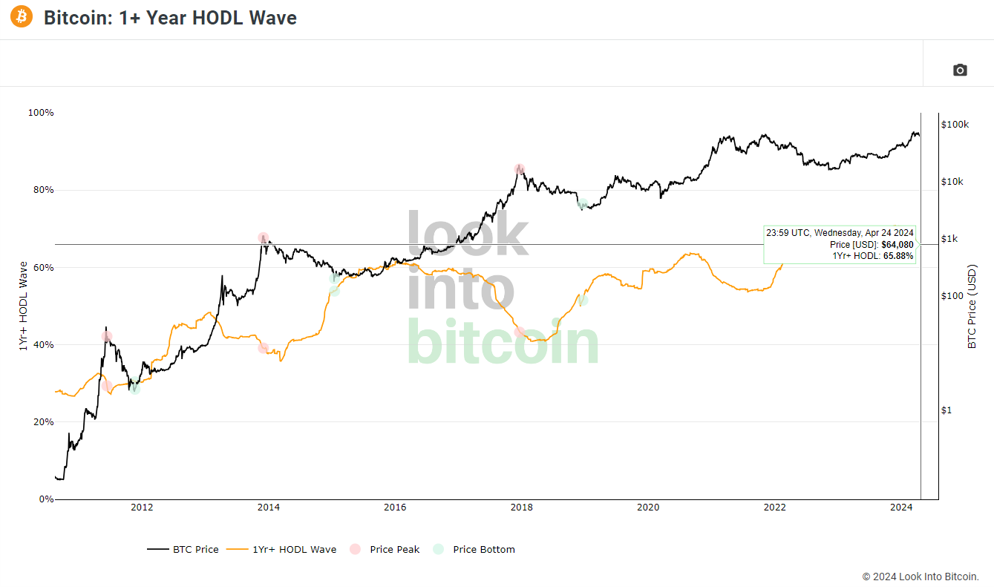

Several network metrics confirm the negative sentiment: the rate of new address creation has decreased to 2021 lows, and the proportion of long-term holders has declined.

The proportion of coins inactive for over a year has decreased from 70.5% in mid-January to the current 65.88%. The population of whales (>1,000 BTC) has grown since mid-March but has not yet reached this year’s peak of 2,159 addresses.

Long-term holders are taking profits, and interest in Bitcoin from new investors has slowed significantly. If current trends persist, the cryptocurrency is facing prolonged consolidation with the risk of a full correction. In the current bull cycle, it remains relatively mild, reaching only 22% in January. Typical of previous rallies are corrections averaging 40%.